Syllabus Edition

First teaching 2018

Last exams

Internal & External Sources of Finance (Cambridge (CIE) O Level Business Studies): Revision Note

Exam code: 7115

Internal sources of finance

An internal source of finance is money that comes from within a business such as owners capital, retained profit and money generated from selling assets

An external source of finance is money that is introduced into the business from outside such as a loan or share capital

Owner’s capital: personal savings

Personal savings are a key source of funds when a business starts up

Owners may introduce their savings or another lump sum, e.g. money received following a redundancy

Owners may invest more as the business grows or if there is a specific need, e.g. a short-term cash flow problem

Retained profit

The profit that has been generated in previous years and not distributed to owners is reinvested back into the business

This is a cheap source of finance, as it does not involve borrowing and associated interest and arrangement fees

The opportunity cost of investing the money back into the business is that shareholders do not receive extra profit for their investment

Sale of assets

Selling business assets which are no longer required (e.g. machinery, land, buildings) generates finance

A sale and leaseback arrangement may be made if a business wants to continue to use an asset but needs cash

The business sells an asset (most likely a building) for which it receives cash

The business then rents the premises from the new owners

E.g. In early 2023, Sainsbury’s announced that it was in talks to sell the prime retail property for £500 million, which will then be leased back to them by the new owners, LXi Reit

Sale of stock

Stock may be sold at reduced prices in order to raise additional finance

This reduces the opportunity cost and storage cost of high inventory levels

It must be done carefully to avoid disappointing customers if stock runs low

E.g. A clothing retail business holds a January sale to get rid of old stock and make space for new Spring stock

Managing working capital

A business can also generate additional finance internally by managing its working capital more effectively

They can negotiate extended payment terms with suppliers

They can incentivise customers to pay more promptly for credit purchases

Evaluating the use of internal finance

Advantages | Disadvantages |

|---|---|

|

|

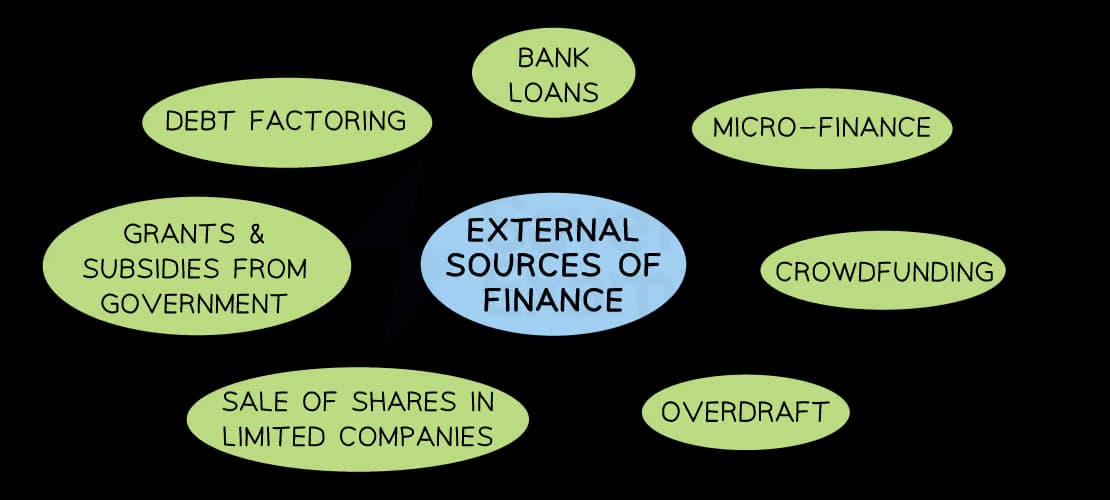

External sources of finance

In some cases, a business may not be able to fulfil its needs with internal sources of finance

Some projects or investments may require a significant amount of finance

External sources, such as loans or issuing shares, can provide the necessary funds for these expensive projects

External sources of finance

The implications of the different types of external finance need to be carefully considered

Interest and fees to arrange finance can vary significantly between financial providers

The percentage of company ownership required in exchange for finance depends on how much risk investors are willing to take

The length of time allowed to repay borrowings or achieve investment targets also varies

Explanation of external sources of finance

Source | Explanation |

|---|---|

Bank overdraft |

|

Bank loan |

|

Hire purchase and leasing |

|

Share issue and debentures |

|

Debt factoring |

|

Trade credit |

|

Grants and subsidies |

|

Businesses also access finance through the use of credit cards or charge cards

These are particularly useful as a means to allow employees to make small purchases that are centrally paid

Interest charges can be high so use is carefully monitored

Alternative sources of finance

In recent years new forms of business funding have become available to business and can provide the funding required

Two of the most common are crowdfunding and microfinance

Explanation of crowdfunding and microfinance

Source | Explanation | Advantages | Disadvantages |

|---|---|---|---|

Crowdfunding |

|

|

|

Microfinance |

|

|

|

Unlock more, it's free!

Did this page help you?