Interest Rates & Saving (AQA Level 3 Mathematical Studies (Core Maths)): Revision Note

Exam code: 1350

What is interest?

Interest is money that is regularly added to an original amount of money

This could be added yearly, monthly, etc

When saving money, interest helps increase the amount saved

With debt, interest increases the amount owed

Simple Interest

What is simple interest?

Simple interest refers to interest which is based only on the starting amount

Each interest payment (or charge in the case of debt) will be the same

To find the total simple interest earned

Find a percentage (the percentage rate) of the starting amount

Use a multiplier to do this, (e.g. 0.05 to find 5%)

Multiply this by the number of time periods, (e.g. years), it is being applied for

To find the total amount (or balance) after the simple interest has been earned

Use the same method as above, and add this on to the starting amount

Worked Example

A bank account offers simple interest of 4% per year. Nigel puts £250 into this bank account, and leaves it to earn interest for 6 years.

(a) Find the total amount of interest earned over the 6 year period.

Answer:

Each year, 4% of the starting amount is added as interest

Find 4% of £250 using a multiplier

0.04 × 250 = 10

This amount of interest is earned every year, for 6 years

10 × 6 = 60

£60 of interest is earned

(b) Find the total amount in the bank account at the end of the 6 year period.

Answer:

Add the amount of interest earned, found in part (a), to the starting amount

250 + 60 = 310

£310

Worked Example

Noah invests £9000 at a rate of simple interest per year, for 5 years. At the end of 5 years there is £11 700 in the account. Find the value of

.

Answer:

Find the total amount of interest earned over the 5 years

11 700 - 9000 = £2700 total interest

As we are dealing with simple interest, the same amount of interest is earned each year

Find the interest earned each year

2700 ÷ 5 = £540 interest per year

Find what percentage of the original amount this represents

540 ÷ 9000 = 0.06 = 6%

£540 is 6% of the original £9000

n = 6

Compound Interest

What is compound interest?

Compound interest is where interest is calculated on the running total, not just the starting amount

This is different from simple interest where interest is only based on the starting amount

E.g. $100 earns 10% interest each year, for 3 years

At the end of year 1, 10% of $100 is earned ($10)

The total balance will now be 100+10 = $110

At the end of year 2, 10% of $110 is earned ($11)

The balance will now be 110+11 = $121

At the end of year 3, 10% of $121 is earned ($12.10)

The balance will now be 121+12.1 = $133.10

How do I calculate compound interest?

Compound interest increases an amount by a percentage, and then increases the new amount by the same percentage

This process repeats each time period (yearly or monthly etc.)

We can use a multiplier to carry out the percentage increase multiple times

To increase $300 by 5% once, we would find 300×1.05

To increase $300 by 5%, each year for 2 years, we would find (300×1.05)×1.05

This could be rewritten as 300×1.052

To increase $300 by 5%, each year for 3 years, we would find ((300×1.05)×1.05)×1.05

This could be rewritten as 300×1.053

This can be extended to any number of periods that the interest is applied for

If $2000 is subject to 4% compound interest each year for 12 years

We would find 2000×1.0412, which is $ 3202.06

Remember to round your final amount to 2 d.p.

Note that this method calculates the total balance at the end of the period, not the interest earned

To find just the interest earned, find the difference between the total balance and the original amount

This method can be summarised as a formula if preferred

After

years,

at an annual interest of

(where

is a decimal),

an amount

will have grown to:

How do I find the number of years to reach a particular balance?

To work out the number of years,

, required to reach a particular balance, use the same equation structure as when finding a balance with a known number of years

Suppose £4000 is invested at 5% per year, and we are required to find how many years it takes to accumulate a balance of at least £6000

Using the same structure as when finding the balance, we can write

The quickest way to find

is by using trial and error

, not larger than 6000 at the end of 6 years

, not larger than 6000 at the end of 8 years

, larger than 6000 at the end of 9 years

At the end of 9 years the balance will be larger than £6000

Worked Example

Jasmina invests £1200 in a savings account which pays compound interest at the rate of 4% per year for 7 years.

To the nearest pound, what is her investment worth at the end of the 7 years?

Answer:

We want an increase of 4% per year, this is equivalent to a multiplier of 1.04

This multiplier is applied 7 times, therefore the final value after 7 years will be

1200 × 1.047 = £1579.118135

Round to the nearest pound

£1579

Worked Example

Robert invests £12 000 in a high risk investment fund which returns 10% interest on average each year.

Find out how many years it would take for Robert's investment to be worth double the amount he started with.

Answer:

The interest is 10%, equivalent to a multiplier of 1.10

This is applied n times, where n is the number of years

When his investment has doubled, it will be worth £24 000

12 000 × 1.10n = 24 000

Use trial and error to find a value of n that results in a value of at least 24 000

12 000 × 1.105 = 19 326.12, not large enough

12 000 × 1.107 = 23 384.61, not large enough

12 000 × 1.108 = 25 723.07, larger than 24 000

Even though the value after 7 years is closer to 24 000 than the value after 8 years, it is still not above the threshold of 24 000

So we must use the next value up to make sure the threshold is met

8 years

AER (Annual Equivalent Rate)

Why is AER useful?

AER (Annual Equivalent Rate) is used to compare different savings accounts across a year, taking into account differences in interest rate and payment intervals

Different savings accounts will pay interest at different intervals

This is usually either annually or monthly

Earning 12% interest, paid at the end of 1 year, will result in a different balance to earning 1% interest, paid monthly (12 times per year)

Consider a balance of £100 paid 12% at the end of 1 year

£100 × 1.121 = £112

Consider the same balance subject to 1% interest, 12 times through the year

£100 × 1.0112 = £112.68

This is equivalent to an Annual Equivalent Rate of 12.68%

AER is used so that the different interest rates and payment intervals can be incorporated into a single figure for easier comparison

How do I calculate AER?

The formula for AER is given on the formula sheet in your exam

The annual effective interest rate (AER),

, is given by

is the nominal interest rate (per annum)

is the number of compounding periods per year

The values of

and

should be expressed as decimals

Be careful with

and

, read the question carefully

is the nominal interest rate per annum

A bank may offer 3% interest annually, paid monthly

This means

and

A bank may offer 0.4% interest per month, paid monthly

The annual nominal interest rate will be 12 times the monthly nominal interest rate

and

Notice that the AER for an account paying interest annually will be equal to

Worked Example

Find the AER for a savings account offering 0.43% interest per month, paid monthly.

Answer:

is the nominal interest rate per annum, whereas the percentage you are given is per month

To find the nominal interest rate per annum, multiply this by 12

Remember that must be a decimal equivalent (0.43%=0.0043)

is the number of compounding periods

In this case interest is paid monthly, so

Substitute the values into the formula

Find the answer using your calculator

This is the AER as a decimal

Convert this to a percentage (multiply by 100)

increase

AER = 5.28%

Worked Example

Jeff is planning to open a new savings account.

Bank A offers 7.16% interest per annum, paid monthly.

Bank B offers 7.15% interest per annum, paid weekly.

Bank C offers 7.17% interest per annum, paid quarterly.

Use AER to determine which bank would offer the best returns for Jeff.

Answer:

Apply the AER formula to each bank

For Bank A, and

(12 months per year)

Bank A provides 7.400% AER (to 3 decimal places)

For Bank B, and

(52 weeks per year)

Bank B provides 7.407% AER (to 3 decimal places)

For Bank C, and

(4 quarters per year)

Bank C provides 7.365% AER (to 3 decimal places)

Bank B would provide the best returns for Jeff

It has an AER of 7.407% to 3 d.p.

Savings & Investments

What are the differences between savings and investments?

Savings are money stored in an account with a known and guaranteed rate of interest

Investments are money that is spent on something that has value, in the hope that its value will increase, but the value could also decrease

The key difference is the level of risk involved

Savings provide a predictable and secure return on the starting amount

Investments include a risk that money may be lost, but the maximum returns could be much higher than a savings account

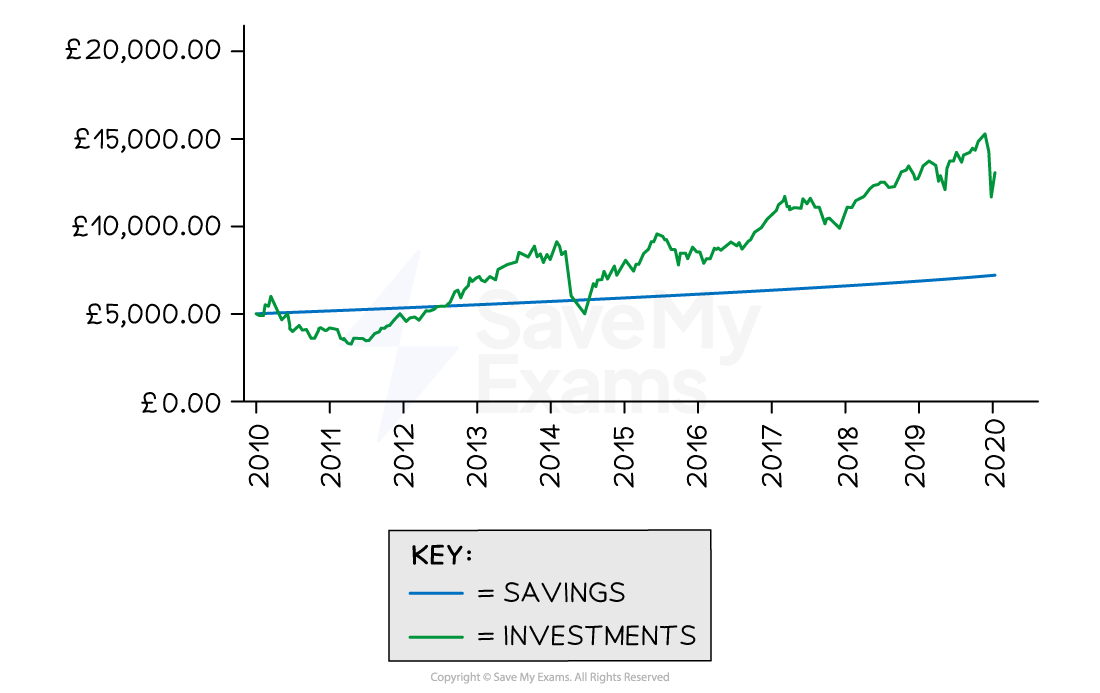

The graph below shows how £5000 could grow when in a savings account, compared to being invested

In this example the value of the investment increases overall, which is never guaranteed

There are several points on the graph where the value of the investment is lower than if it had been placed in a savings account

Advantages and disadvantages of savings and investments

Savings | Investments | |

|---|---|---|

Advantages |

|

|

Disadvantages |

|

|

Best usage |

|

|

Unlock more, it's free!

Was this revision note helpful?