Revenue, Costs & Profit (Edexcel IGCSE Business): Revision Note

Exam code: 4BS1

Revenue

Revenue is the value of the units sold by a business over a period of time

E.g the revenue earned by Apple Music from sales of music downloads

Revenue is calculated using the formula

Revenue usually increases as the sales volume increases

It should not be defined as 'money earned' as businesses can receive earnings from investments such as savings

Worked Example

Fotherhill Organics Limited sold 39,264 packs of its specialist compost to mail-order customers in 2022. The price per pack was £8.75. In addition, it sold 4,275 tonnes to gardening businesses for £123.95 per tonne.

Calculate Fotherhill Organics revenue for 2022.

[3]

Step 1: Calculate the revenue from sales to mail-order customers

39,264 x £8.75 = £343,560 [1 mark]

Step 2: Calculate the revenue from sales to gardening businesses

4,280 x £123.95 = £530,506 [1 mark]

Step 3: Add the two revenue figures together

£343,560 + £530,506 = £874,066 [1 mark]

Examiner Tips and Tricks

You may be required to calculate the average selling price using the revenue figure

In these instances you need to divide the sales revenue by the number of items sold

Fixed, variable and total costs

In preparing goods/services for sale, businesses incur a range of costs

Some examples of these these costs include purchasing raw materials, paying staff salaries and wages, and paying utility bills such as electricity

These costs can be broken into different categories

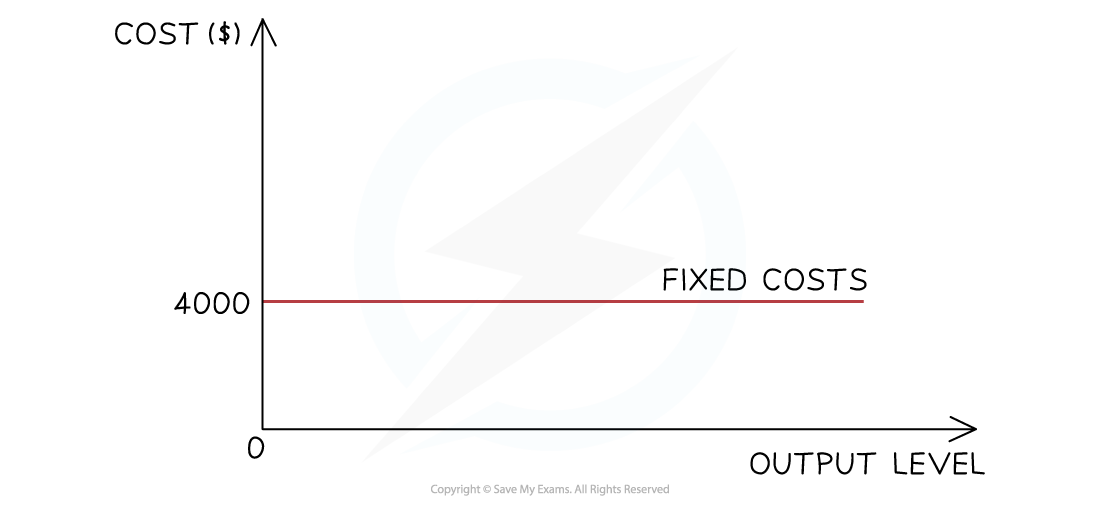

Fixed costs (FC) are costs that do not change as the level of output changes

These have to be paid whether the output is zero or 5000

E.g. building rent, management salaries, insurance, bank loan repayments etc.

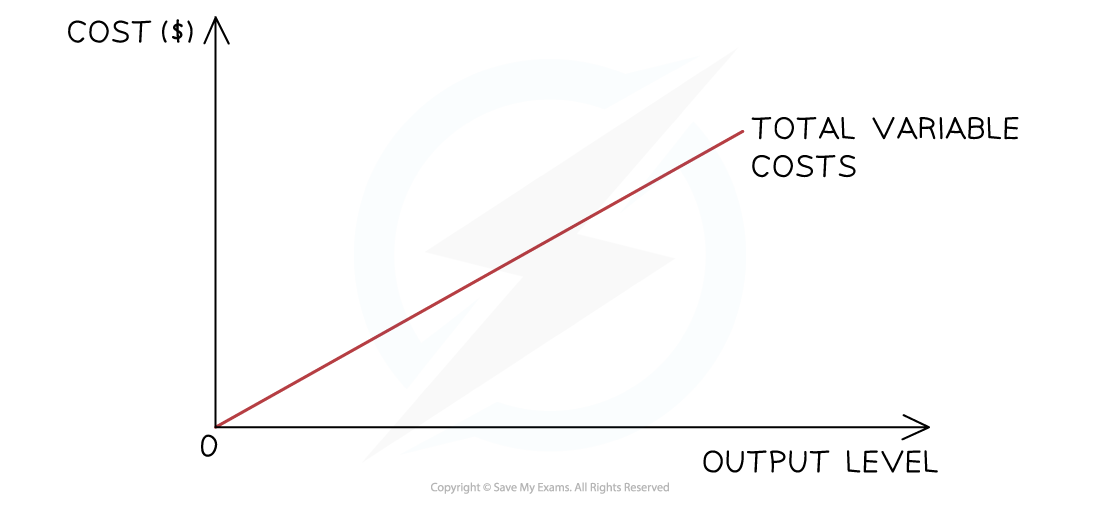

Variable costs (VC) are costs that vary directly with the output

These increase as output increases & vice versa

E.g. raw material costs, wages of workers directly involved in the production

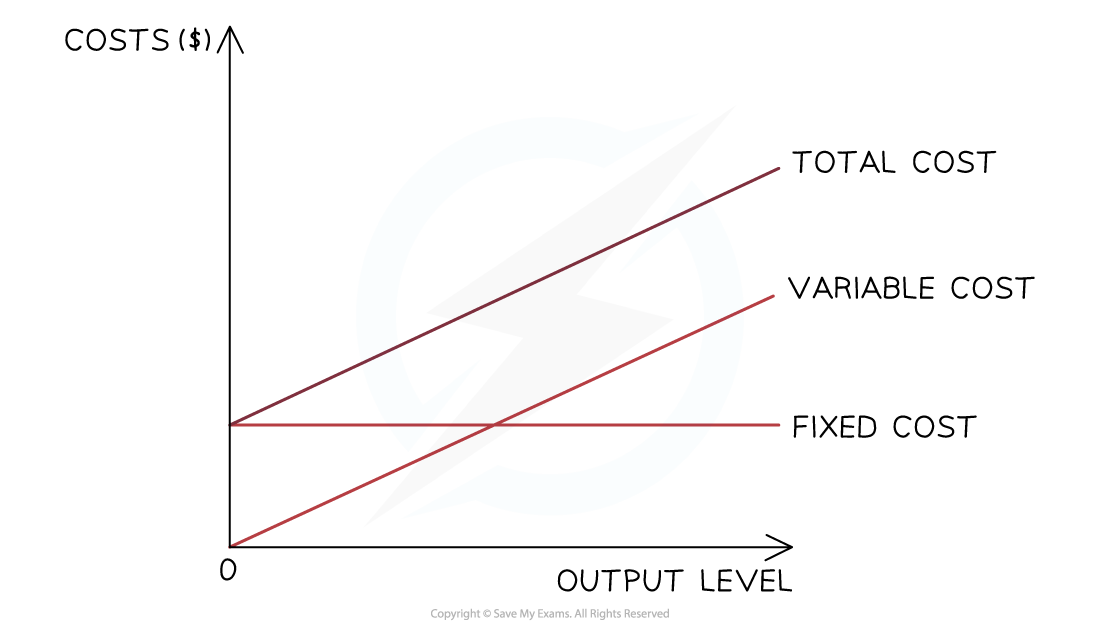

Total costs (TC) are the sum of the fixed + variable costs

Different types of cost

Type of cost | Diagram | Explanation |

|---|---|---|

Fixed Cost (FC) |  |

|

Variable cost (VC) |  |

|

Total cost (TC) |  |

|

Worked Example

Fotherhill Organics Limited sold 43,539 packs of its specialist compost to mail-order customers in 2022. The cost to make and deliver each pack was £3.40. In addition, it incurred total fixed costs of £430,000

Calculate Fotherhill Organics total costs for 2022.

[2]

Step 1: Calculate the total variable costs of compost

[1 mark]

Step 2: Add total variable costs to total fixed costs

[1 mark]

Profit and loss

Profit is a surplus that remains after business costs have been subtracted

If costs exceed revenue the business makes a loss

Most businesses have the main objective of making a profit

Profits help new businesses to survive and break-even

It is a reward for risks taken by entrepreneurs and investors

Established businesses can use profit to fund long-term growth

The most simple formula for calculating profit is:

How profit is made

Profit can be increased using the following strategies

Increasing revenue

Reducing costs

A combination of increasing revenue and reducing costs

Worked Example

In 2022 Fotherhill Organics Limited achieved revenue of £874,066 from sales of its specialist compost. In addition, it incurred total costs of £578,033

Calculate Fotherhill Organics profit for 2022 [1]

Step 1: Subtract total costs from revenue

[1 mark]

Examiner Tips and Tricks

When you answer calculation questions remember

Take care that your figures are easily recognisable - in some cases the number 4 and the number 9 could be confused by the examiner

Check the number of decimal places or significant figures required - if you only give your answer to one decimal place rather than two you will lose a mark, even if your answer is correct

Place your final solution on the dotted line at the bottom of the answer box

You've read 0 of your 5 free revision notes this week

Unlock more, it's free!

Did this page help you?