Price: The Significance of Price Elasticity of Demand (Cambridge (CIE) IGCSE Business) : Revision Note

An Introduction to Price Elasticity of Demand

Price elasticity of demand (PED) measures how responsive demand for a product is to a change in price

In most cases an increase in price leads to a fall in demand for a product

Similarly a fall in price leads to an increase in demand for a product

Price elasticity of demand answers the question of by how much demand changes?

Price elastic demand is where the volume of a product's sales changes by a greater percentage than the change in price

E.g. A 10% increase in price leads to a 20% decrease in the volume of sales

Price inelastic demand is where the volume of a product's sales changes by a smaller percentage than the change in price

E.g. A 10% increase in price leads to a 5% decrease in the volume of sales

Calculation of PED

Price elasticity of demand is calculated using the formula

PED will always be negative due to the inverse relationship between price and quantity

If the price goes up the quantity demanded goes down

If the price goes down the quantity demanded goes up

The numerical value of PED indicates the responsiveness of a change in quantity demanded to a change in price

Interpretation of PED Values

Numerical Value | Explanation | Examples |

|---|---|---|

> 1 ELASTIC |

|

|

Between 0 & 1 INELASTIC |

|

|

The Significance of Price Elasticity of Demand

If businesses can determine the price elasticity of demand for their products, they can adjust their pricing strategy to maximise their revenue

If the demand for their products is relatively price inelastic (PED < -1), raising the price will lead to an increase in total revenue. However, lowering the price will lead to a fall in total revenue

Price skimming strategies are best employed for products that are price inelastic in demand

If demand for their products is relatively price elastic (PED > -1), raising the price will lead to a fall in total revenue. However, lowering the price will lead to a rise in total revenue

Competitive pricing strategies are best employed for products that are price inelastic in demand

The Relationship Between Price Elasticity of Demand and Total Revenue

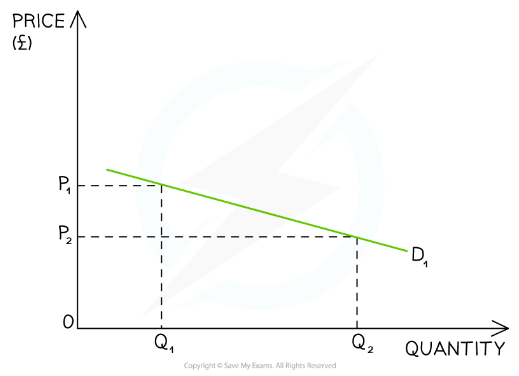

Price elastic demand

The ratio outcome is greater than 1 (Between 1 and ∞)

An increase in price will lead to a decrease in revenue

A decrease in price will lead to an increase in revenue

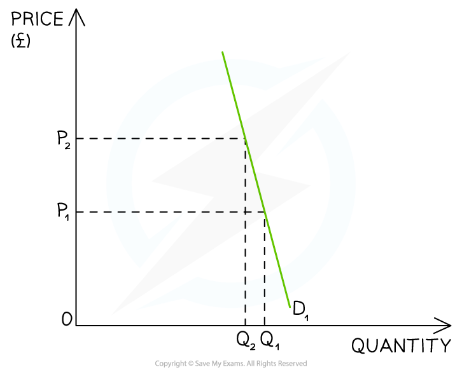

Price inelastic demand

The ratio outcome is between 0 and 1

An increase in price will lead to an increase in revenue

A decrease in price will lead to a decrease in revenue

Factors Influencing the Price Elasticity of Demand

Diagram: PED influencers

Brand loyalty

The aim of advertising and marketing expenditure by a business is to shift the demand curve to the right and make the demand more price inelastic

E.g. Coke consumers tend to remain brand loyal to Coke and are unlikely to buy Pepsi even though their taste and selling price are very similar

Availability of substitutes

Demand for goods that have fewer substitutes is likely to be price inelastic

E.g. Petrol has fewer substitutes and is more price inelastic whereas chocolate bars have more substitutes and are more price elastic

The proportion of income taken up by the product

The smaller the proportion of income we spend on a product the more price inelastic the demand will be

E.g. A small amount of income is spent on salt and so demand for salt is more price inelastic whereas buying a new car takes up a bigger proportion of consumer income and so demand is more price elastic

Luxury or necessity

Necessities are required as part of consumers' daily needs and are therefore more price inelastic in demand

E.g. Bread, milk, petrol, gas and electricity might be considered to be necessities

Luxuries are not essential and are therefore more price elastic in demand

E.g. Smoked salmon, Nike Air Jordans, and foreign holidays might be considered to be luxuries

Time

The longer the time period under consideration the more price elastic the demand for a good or service is likely to be (consumers have more time to search for substitutes)

The shorter the time period under consideration the more price inelastic the demand for a good or service is likely to be

For example, if the price of petrol increases, making driving more expensive, there is little that consumers can do in the short term but pay the price required to keep their vehicle running

Over time they may switch to alternatives such as public transport or bicycles so demand for petrol could be more price elastic in the long-term

You've read 0 of your 5 free revision notes this week

Unlock more, it's free!

Did this page help you?