Syllabus Edition

First teaching 2018

Last exams 2026

Types of Business Growth (Cambridge (CIE) IGCSE Business): Revision Note

Exam code: 0450, 0986 & 0264, 0774

Reasons for business growth

Many firms start small & will grow into large companies or even multi-national corporations

E.g. Amazon and Dell both started in entrepreneurs' garages

Reasons why businesses grow

|

|

|

|

|

|

Methods of business growth

Business growth can be achieved by growing organically, or inorganically (mergers and takeovers)

1. Organic (internal) growth

Organic growth is growth that is driven by internal expansion using reinvested profits or loans

It is usually achieved by:

Gaining a greater market share

Product diversification

Opening new outlets

International expansion (new markets)

Investing in new technology/production machinery

Examples of organic growth

Business | Explanation |

|---|---|

Apple |

|

| |

Disney |

|

Product diversification opens up new revenue streams for a business

Firms may spend money on research and development, or innovation to existing products to help create a new revenue stream

Firms will often grow organically to the point where they are in a financial position to integrate (merge or buy) with others

Integration speeds up growth but also creates new challenges

Evaluating internal growth

Advantages | Disadvantages |

|---|---|

|

|

2. Inorganic (external) growth

Firms will often grow organically to the point where they are in a financial position to integrate (merge or takeover) with others

Integration in the form of mergers or takeovers results in rapid business growth and is referred to as external or inorganic growth

A merger occurs when two or more companies combine to form a new company

The original companies cease to exist and their assets and liabilities are transferred to the newly created entity

A takeover occurs when one company purchases another company, often against its will

The acquiring company buys a controlling stake in the target company's shares (>50%) and gains control of its operations

Vertical integration

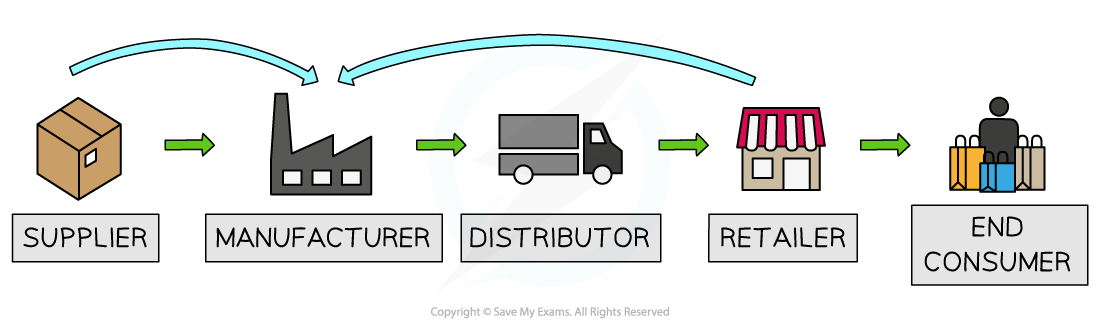

Vertical integration refers to the merger or takeover of another firm in the supply chain or different stage of the production process

Forward vertical integration involves a merger with or takeover of a firm further forward in the supply chain

E.g. A dairy farmer merges with an ice cream manufacturer

Backward vertical integration involves a merger with or takeover of a firm further backwards in the supply chain

E.g. An ice cream retailer takes over an ice cream manufacturer

Horizontal integration

Horizontal integration is the merger or takeover of a firm at the same stage of the production process

E.g. An ice cream manufacturer merges with another ice cream manufacturer

Evaluating external growth

Type of growth | Advantages | Disadvantages |

|---|---|---|

Vertical integration |

|

|

Horizontal integration |

|

|

Unlock more, it's free!

Did this page help you?