Methods of Depreciation (Edexcel IGCSE Accounting): Revision Note

Exam code: 4AC1

Straight line depreciation

What is the straight line method of depreciation?

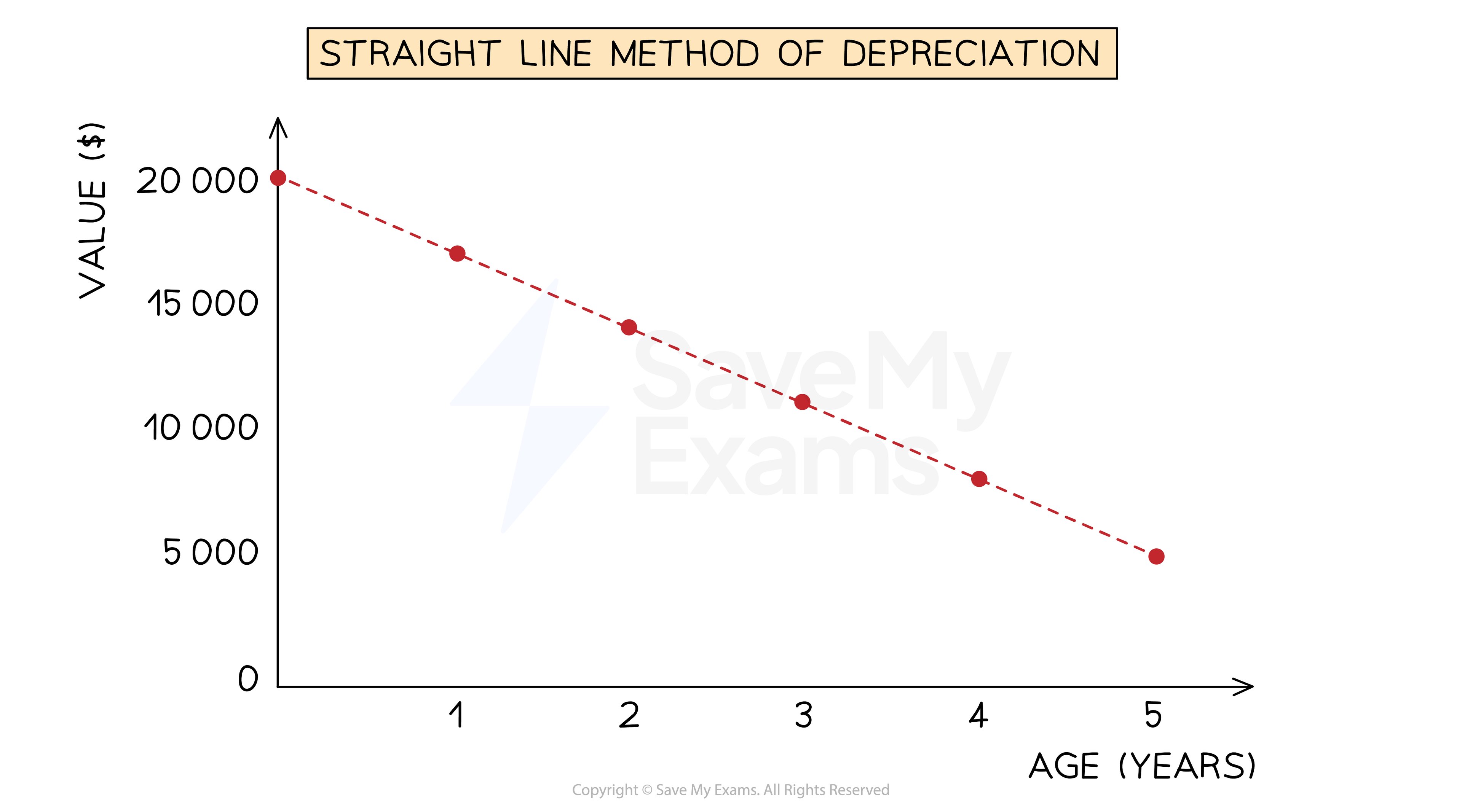

The straight line method of depreciation assumes that a non-current asset loses value at a constant rate over its useful life

This means that the expense for its depreciation is the same each year

The carrying value can reach $0

This is when the asset is fully depreciated

You could be given the depreciation rate as a percentage of its original value

E.g. depreciation could be charged at 20% of its original cost

Or you could be expected to calculate the depreciation using:

The number of years that the non-current asset will be used

The expected value of the non-current asset at the end of its working life

This value could be $0

The expected value is also called the residual value or the disposal value

This method is usually used when the asset will be equally valuable for each year of its use

For example, fixtures and fittings, equipment, etc

How do I calculate depreciation using the straight line method?

If you are given the percentage for the depreciation

Find the percentage of the original amount

This will be the yearly depreciation charge

If you are not given the percentage

Calculate the expected loss in value during the expected life of the non-current asset

The original value minus the expected value at the end of its life

Divide the loss by the number of years it will be used

This will be the yearly depreciation charge

Examiner Tips and Tricks

The straight line method is similar to simple interest calculations used in maths.

Worked Example

Abi purchases machinery for $18 000. Machinery is depreciated at 15% per annum using the straight line method.

Calculate the carrying value of the machinery after 3 years.

Answer

Calculate the yearly expense due to depreciation

15% ✕ $18 000 = $2 700

Calculate the total depreciation after 3 years

3 ✕ $2 700 = $8 100

Subtract the depreciation from the original value

$18 000 - $8 100 = $9 900

Worked Example

Taiki purchases a vehicle for $30 000. He expects to use the vehicle for 3 years, after which he estimates that it will have a value of $12 000.

Calculate the yearly expense due to the depreciation of the vehicle.

Answer

Calculate the loss in value over the 3 years

$30 000 - $12 000 = $18 000

Divide this by the number of years

$18 000 ÷ 3 = $6 000

Reducing balance depreciation

What is the reducing balance method of depreciation?

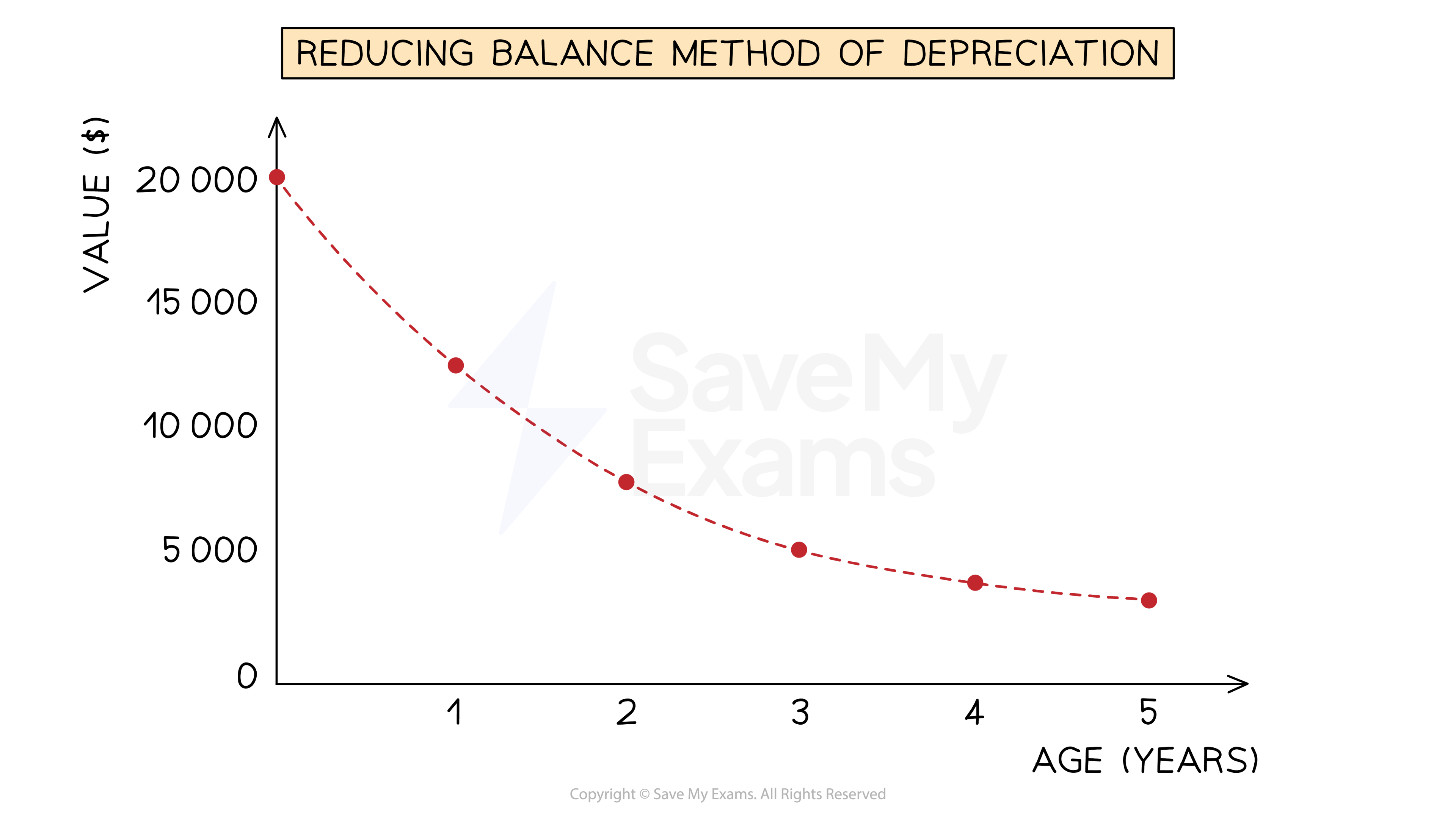

The reducing balance method of depreciation assumes that the non-current asset loses value at a rate proportional to its current value

This means that the expense for its depreciation gets smaller each year as the current value decreases

You will be told the percentage of the current value to use for depreciation

This method is usually used when a non-current asset initially loses value at a fast rate

How do I calculate depreciation using the reducing balance method?

Find the percentage of the current carrying value

This will be the depreciation charge for that year

If you need to calculate the depreciation for multiple years, then calculate one year at a time

Find the depreciation charge for one year using the carrying value at that start of the year

Subtract this amount from the carrying value at the start of the year to find the new carrying value

Find the depreciation charge for the next year using the carrying value at the start of that year

Continue this process

If you just need to find the current carrying value then you can use some maths skills

Subtract the percentage from 100%

Write this as a decimal

Raise this to the power of the number of years

Multiply this by the original value

Examiner Tips and Tricks

The reducing balance method is similar to compound interest calculations used in maths.

Amounts should always be given to the nearest dollar in exams.

Worked Example

Abi purchases a vehicle for $16 000. Machinery is depreciated at 25% per annum using the reducing balance method.

Calculate the carrying value of the machinery after 3 years.

Answer

Find the depreciation charged in each year by finding the percentage of the carrying value at that time.

Subtract that year’s depreciation from the carrying value to find the carrying value at the end of the year.

End of year | Depreciation charge | Carrying value |

0 | - | $16 000 |

1 | 25% ✕ $16 000 = $4 000 | $16 000 - $4 000 = $12 000 |

2 | 25% ✕ $12 000 = $3 000 | $12 000 - $3 000 = $9 000 |

3 | 25% ✕ $9 000 = $2 250 | $9 000 - $2 250 = $6 750 |

Alternatively:

Subtract the percentage from 100%

100% - 25% = 75%

Write this as a decimal

75% = 0.75

Raise this to the power of the number of years

0.753

Multiply this by the original value

$16 000 ✕ 0.753 = $6 750

Unlock more, it's free!

Did this page help you?