The Statement of Financial Position (AQA GCSE Business): Revision Note

Exam code: 8132

Assets and liabilities

Assets

Assets are items that are owned by a business

Two types of assets appear in the statement of financial position

Non-Current Assets are items owned by the business in the long-term

Examples include tangible assets such as buildings, land, machinery and vehicles

Non-current assets may be intangible such as patents, goodwill or brand value

Current Assets include cash and items that can be turned into cash relatively quickly, usually within 12 months

The four types of current assets are cash in hand, cash in bank, trade receivables and inventory

Liabilities

Liabilities are items that are owed by a business

Two types of liabilities appear in the statement of financial position

Current Liabilities are short-term financial obligations that a business must usually pay within one year, or as demanded by its creditors

E.g. Trade payables and bank overdrafts

Non-current Liabilities are moneys owed by a business that are due to be repaid over a period longer than twelve months

E.g. Long term loans and mortgages

Structure of the statement of financial position

The Statement of Financial Position shows the financial structure of a business at a specific point in time

It is included as a key financial statement in the annual report

It identifies a businesses assets and liabilities and specifies the capital (equity) used to fund the business operations

The Statement of Financial Position is sometimes known as the Balance Sheet

It is called the balance sheet as the net assets are equal to the total equity

The statement of financial position generally follows the structure shown below

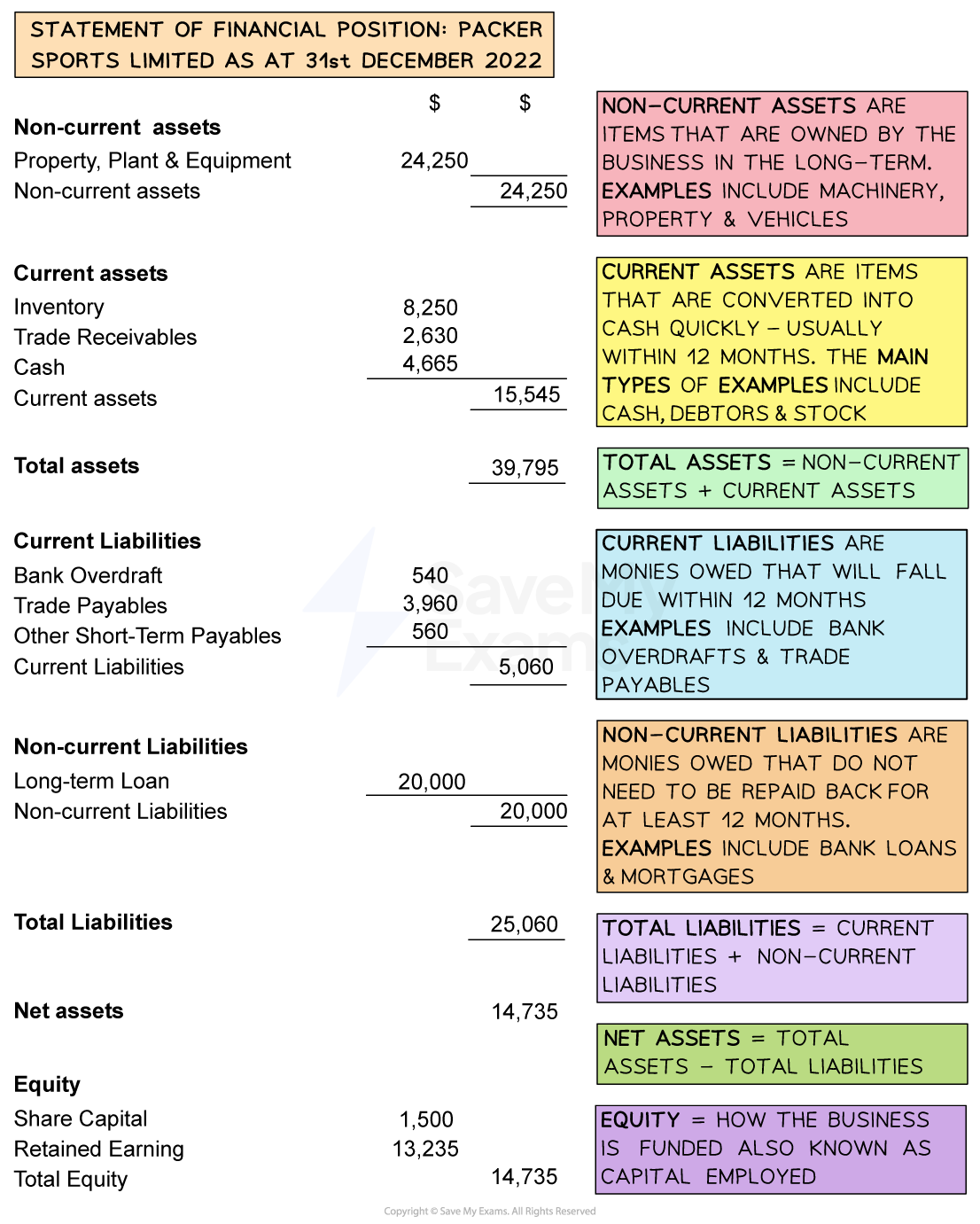

Statement of financial position

Interpreting the statement of financial position

Several deductions can be made from the statement about how a business finances its activities,

Financing its activities

Packer Sports Limited is funded through share capital of $1,500 and retained earnings of $13,235

The business has long-term liabilities in the form of a loan for $20,000

This is significantly greater than share capital so its gearing is high

Future applications for loans may be declined as the business is likely to be seen as a lending risk

What the business owns

On the stated date, Packer Sports Ltd owned assets worth $39,795 in total

Non-current assets of $24,250 consisting of property, machinery (plant) and other equipment

Current assets worth $15,545, comprised of inventory, trade receivables and cash

Inventory will be sold and converted to cash or trade receivables

When trade payables pay their invoices they will become cash

What the business owes

On the stated date, the business had total liabilities of $25,060

Its current liabilities were $5,060, comprised of a bank overdraft, trade payables and other short-term loans

Its long-term liabilities were valued at $20,000

Examiner Tips and Tricks

You are not required to construct a statement of financial position in the exam, but you may be asked to define assets and liabilities or identify the statement's uses and key components.

Unlock more, it's free!

Did this page help you?