The Marketing Mix: Advanced Pricing Strategies (DP IB Business Management): Revision Note

Dynamic pricing strategy

Dynamic pricing involves charging different prices to match demand patterns

It aims to maximise revenue whilst making full use of capacity available

Prices are raised if demand is high and limited capacity remains

Prices are lowered if demand is low and needs to be stimulated to maximise capacity utilisation

Examples of dynamic pricing

Disneyland Paris Resort | American Airlines |

|---|---|

| |

|

|

Dynamic pricing can be used very effectively online

Demand is tracked in real time and prices can be programmed to change accordingly

Using artificial intelligence (AI) Amazon can change prices on products several times a day according to market demands

Advanced algorithms analyse sales data, detect patterns and make price changes at a fraction of the speed of competitors

This allows Amazon to nearly always have the most compelling offers faster than other retailers

Advantages and disadvantages of dynamic pricing

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

|

|

Examiner Tips and Tricks

Students often confuse the negative sign of the answer to PED questions. Do not assume that the negative is mathematical such that an elasticity of -1 is smaller than, for example, -0.3. It is larger (more price elastic).

When interpreting the value of PED do not say that ‘the product is elastic or inelastic’, it is better to say that ‘demand for the product is price elastic or price inelastic’.

Competitive pricing strategy

Competitive pricing involves matching or undercutting the prices charged by competitors in order to increase sales

Businesses can use a range of pricing tactics

Price matching is commonly used by UK supermarkets to highlight products that are sold at a lower price than rivals

Refund the difference matches the price of rivals if customers find a product at a lower price in a comparable retail outlet

Discounts for new customers attract sales away from rivals

Supermarket price matching

The above image illustrates how businesses engage in a competitive pricing strategy

Businesses with many products may price some competitively while raising prices on others

E.g. supermarkets will often use competitively priced alcohol to bring customers in but then raise the prices on other products, such as deli meat

Advantages and disadvantages of competitive pricing

Advantages | Disadvantages |

|---|---|

|

|

|

|

|

|

Contribution pricing

Contribution pricing involves setting prices that cover direct costs associated with producing a product and also contribute to covering indirect costs

This method ensures that a business does not make a loss on each product sold

It requires a business to be able to accurately allocate indirect costs to products in its range

Care must be taken to ensure that the price set is competitive and meets market expectations

An illustration of contribution pricing

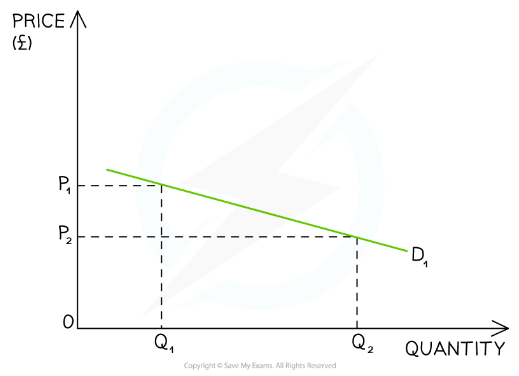

Price elasticity of demand's influence on pricing

Understanding price elasticity of demand helps a business to know when to raise its prices - and when to lower them

Price elasticity of demand calculates how responsive the change in quantity demanded of a product will be to a change in its price

For most products, when there is an increase in price, there will be a fall in the quantity demanded

Similarly when there is a decrease in price there will be an increase in the quantity demanded

Businesses want to know by how much the demand will change as this can impact their pricing strategy

The responsiveness of demand to a change in price determines if the product is price elastic or price inelastic in nature

Where the quantity demanded changes more than the change in price, demand is price elastic

Businesses should avoid raising the price of these products

A 10% increase in price would lead to a greater than 10% decrease in the quantity demanded

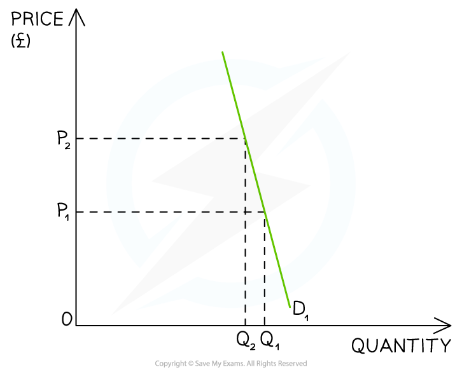

Where the quantity demanded changes less than the change in price demand is price inelastic

Businesses should avoid cutting the price of these products

A 10% increase in price would lead to a less than 10% decrease in the quantity demanded

Calculation of PED

The PED value is always negative because of the inverse relationship between price and demand (one goes up when the other goes down)

PED can be calculated using the following formula

Interpretation of PED values

Numerical value | Explanation | Examples |

|---|---|---|

> 1 ELASTIC |

|

|

Between 0 & 1 INELASTIC |

|

|

PED and pricing strategy

Businesses need to understand the responsiveness of demand to a change in price before setting or changing their pricing strategy to maximise their revenue

If the demand for their products is relatively price inelastic (PED < -1), raising the price will lead to an increase in total revenue. However, lowering the price will lead to a fall in total revenue

Price skimming strategies are best employed for products that are price inelastic in demand

If demand for their products is relatively price elastic (PED > -1), raising the price will lead to a fall in total revenue. However, lowering the price will lead to a rise in total revenue

Competitive pricing strategies are best employed for products that are price inelastic in demand

Price elasticity of demand and total revenue

Price elastic demand

The ratio outcome is greater than 1 (Between 1 and ∞)

An increase in price will lead to a decrease in revenue

A decrease in price will lead to an increase in revenue

Price inelastic demand

The ratio outcome is between 0 and 1

An increase in price will lead to an increase in revenue

A decrease in price will lead to a decrease in revenue

Factors influencing price elasticity of demand

Brand loyalty

The aim of advertising and marketing expenditure by a business is to shift the demand curve to the right and make the demand more price inelastic

E.g. Coke consumers are more brand loyal to Coke and refuse to buy Pepsi, even though their taste is very similar

Availability of substitutes

PED will be more price inelastic (lower) for goods that have fewer substitutes

E.g. Petrol has fewer substitutes and is more price inelastic, whereas chocolate bars have more substitutes and are more price elastic

The proportion of income taken up by the product

The smaller the proportion of income we spend on a product, the more price inelastic the demand will be

E.g. A small amount of income is spent on salt and so the demand for salt will be more price inelastic, whereas buying a new car takes up a bigger proportion of consumer income and so is more price elastic in demand

Luxury or necessity

Necessities are required as part of consumers' daily needs and are therefore more price inelastic in demand

E.g. Bread, milk, petrol, gas and electricity might be considered necessities

Luxuries are not essential and are therefore more price elastic in demand

E.g. Smoked salmon, Nike Air Jordans, and foreign holidays might be considered to be luxuries

Time period to adjust

The longer the time period under consideration, the more price elastic the demand for a good or service is likely to be (consumers have more time to search for substitutes)

The shorter the time period under consideration, the more price inelastic the demand for a good or service is likely to be

E.g. If the price of petrol increases, making driving more expensive, there is little that consumers can do in the short term. However, they may switch to alternatives such as public transport or bicycles in the long term

Unlock more, it's free!

Did this page help you?