Government Intervention in Markets (Edexcel A Level Economics A): Revision Note

Exam code: 9EC0

Government Intervention in Markets

Nearly every economy in the world is a mixed economy and has varying degrees of government intervention

Government intervention is necessary for several reasons

Correct market failure: in many markets there is a less than optimal allocation of resources from society's point of view

In maximising their self-interest, firms and individuals will not self-correct this allocation of resources and there is a role for the government

They often achieve this by influencing the level of production or consumption

Earn government revenue: governments need money to provide essential services, public and merit goods

Revenue is raised through intervention such as taxation, privatisation, sale of licenses (e.g. 5G licenses), and sale of goods/services

Promote equity: to reduce the opportunity gap between the rich and poor

Support firms: in a global economy, governments choose to support key industries so as to help them remain competitive

Support poorer households: poverty has multiple impacts on both the individual and the economy

Intervention seeks to redistribute income (tax the rich and give to the poor) so as to reduce the impact of poverty

Four of the most common methods used to intervene in markets are indirect taxation, use of subsidies, maximum prices, and minimum prices

Indirect taxation

An indirect tax can be either ad valorem or specific

Ad Valorem tax

Value added tax (VAT) is 20% in the UK in 2024. The more goods/services consumed, the larger the tax bill

This causes the second shifted supply curve to diverge from the original supply curve

VAT raises significant government revenue. It is the third biggest source of tax revenue after income tax and national insurance in the UK

Diagram analysis

Initial equilibrium is at P1Q1

Supply shifts left due to the tax from S → S + tax

The two supply curves diverge as percentage tax means more tax per unit is paid at higher prices

Consumer incidence of tax is (P2 - P1) x Q2 - Area A

Producer incidence of tax is (P1 - P3) x Q2 - Area B

New equilibrium is at P2Q2

Final price is higher (P2) and QD is lower (Q2)

Specific tax on negative externality of production

Governments frequently tax firms that pollute or create harmful external costs in production

Diagram analysis

The free-market equilibrium is at PeQe - where MSB = MPC

Market failure exists as MSC > MSB at equilibrium

Optimum level of output is at Qopt

There is over-provision of this product

A specific tax shifts the supply curve left from S → S1

The tax does not completely eradicate the welfare loss but moves the market closer to the optimum level of output (Qopt)

The welfare loss has been reduced as shown in the diagram

The new market equilibrium is at P1Q1

This is a higher price and less output

There is less over-provision and so less market failure

The external costs have been reduced

Governments frequently tax the production of goods and services that create environmental harm or damaging health consequences. Some examples include intensive factory farming, oil drilling, the manufacture of chemicals and the construction of new roads or runways at airports

Subsidies

Governments frequently use subsidies to encourage production/consumption of merit goods such as energy efficient products, electric vehicles, healthcare, and education

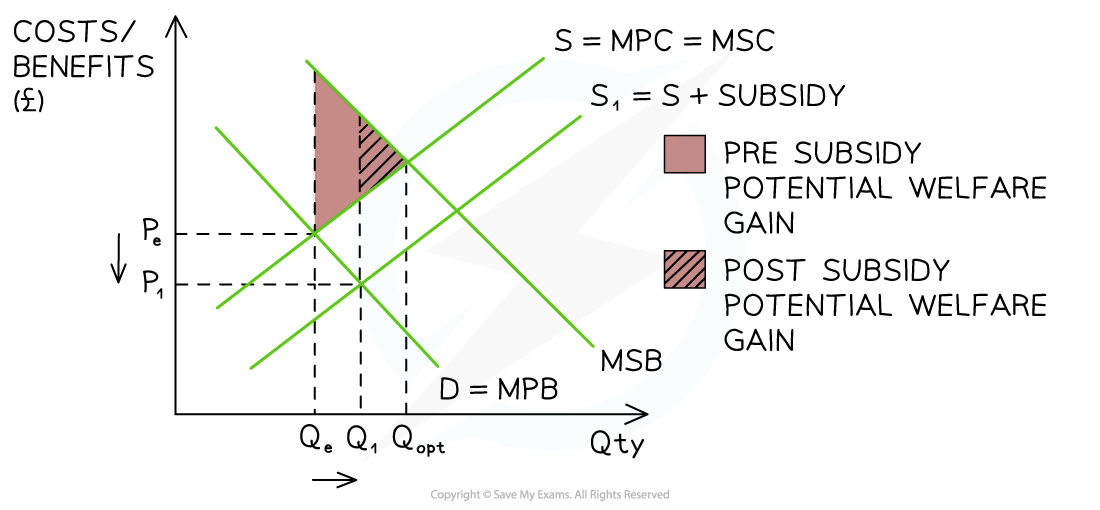

Diagram analysis

The free-market equilibrium is at PeQe - where MPB = MSC

Market failure exists as MSB > MSC at equilibrium

Optimum level of output is at Qopt

There is under-consumption of this product

A subsidy shifts the supply curve right from S → S1

It does not completely eradicate the potential welfare gain but moves the market closer to the optimum level of output (Qopt)

The potential welfare gain has been reduced as shown in the diagram

The new market equilibrium is at P1Q1

This is a lower price and higher output

There is less under-consumption and so less market failure

Some of the external benefits available have been realised

Maximum Prices

Governments will often use maximum prices or price caps (opens in a new tab) in order to help consumers. Sometimes they are used for long periods of time, e.g. housing rental markets. Other times they are short-term solutions to unusual price increases, e.g. fuel

A maximum price is set by the government below the existing free market equilibrium price and sellers cannot legally sell the good/service at a higher price

Diagram analysis

Initial market equilibrium is at PeQe

A maximum price is imposed at Pmax

The lower price reduces the incentive to supply and there is contraction in QS from Qe → Qs

The lower price increases the incentive to consume and there is an extension in QD from Qe → Qd

This creates a condition of excess demand QsQd

Some consumers benefit as they purchase at lower prices

Others are unable to purchase due to the shortage

This unmet demand usually encourages the creation of illegal markets (black/grey markets)

Minimum Prices

Governments will often use minimum prices in order to help producers or to decrease consumption of a demerit good e.g. alcohol

A minimum price is set by the government above the existing free market equilibrium price and sellers cannot legally sell the good/service at a lower price

Minimum prices are also used in the labour market to protect workers from wage exploitation. These are called minimum wages

Diagram analysis

Initial market equilibrium is at PeQe

A minimum price is imposed at Pmin

The higher price increases the incentive to supply and there is an extension in QS from Qe → Qs

The higher price decreases the incentive to consume and there is a contraction in QD from Qe → Qd

This creates a condition of excess supply QdQs

Differences in government responses to the excess supply

In agricultural markets, if a minimum price is set by the government producers benefit as they receive a higher price

Governments will often purchase the excess supply and export it

In demerit markets, producers suffer as QD contracts

Governments will not purchase the excess supply

Producers usually lower their output in the market to match the QD at the minimum price

Other Methods of Government Intervention

Trade Pollution Permits

Governments create a pollution permit market and issue permits to polluting firms

This helps to reduce negative externalities of production

Each permit is typically valid for the emission of one ton of pollutant

More polluting firms have to buy additional permits from less polluting firms

The price of the permit represents an additional cost of production

If the price of additional permits is more than the cost of investing in new pollution technology, firms will be incentivised to switch to cleaner technology:

Firms can then sell their spare permits and gain additional revenue

State Provision of Public Goods

Public goods are beneficial for society and are not provided by private firms due to the free rider problem

They are usually provided free at the point of consumption, but are paid for through general taxation

Examples include roads, parks, lighthouses, national defence

Provision of Information

Information gaps cause market failure

Governments can set up information portals so as to reduce the asymmetric information

Examples include job centres, consumer rights websites, nutritional labels like the traffic light system (opens in a new tab)

Regulation

Governments create rules to limit harm from negative externalities of consumption/production

They create regulatory agencies to monitor that the rules are not broken

There are more than 90 regulators in the UK

Individuals or firms may be fined/imprisoned for breaking the rules

Examples of some industry regulators include the Environment Agency, Ofsted, and the Financial Conduct Authority

Unlock more, it's free!

Did this page help you?