Using the data in Extract D (Figure 3), calculate, to the nearest pound, the amount of income tax payable for someone in Scotland earning £13 500.

Case Study

Extract D

Was this exam question helpful?

Exam code: 7136

Select a download format for 13. Fiscal & Supply-Side Policies

Select an answer set to view for

13. Fiscal & Supply-Side Policies

Using the data in Extract D (Figure 3), calculate, to the nearest pound, the amount of income tax payable for someone in Scotland earning £13 500.

Extract D

How did you do?

Was this exam question helpful?

Explain how the data in Extract D (Figure 2) show that the UK’s public finances have been improving since 2010.

Extract D

How did you do?

Was this exam question helpful?

Extract E (lines 9–10) states ‘Improvements in productivity on the supply side of the economy could actually lead to more deflation.’

With the help of a diagram, explain how improvements in productivity could cause deflation

Extract E: Good and bad deflation

Deflation is bad when it is the result of falling aggregate demand. Consumers buy fewer goods and services and firms cut prices whilst consumption and investment decisions are delayed. This can lead to worsening company profits, cost cutting and job losses. Less spending damages economic growth and could lead to a deflationary spiral. However, this has not been the UK’s recent experience. A glut in the supply of oil has driven down its price. This has had a positive effect on most businesses who face lower costs. In the retail sector, in particular, prices are lower because goods are cheaper to manufacture and transport. Businesses can also spend more on investment, hiring staff or offering pay rises. This has led to pay growth and productivity gains in the private sector after years of stagnation. Improvements in productivity on the supply side of the economy could actually lead to more deflation but this could be viewed as good deflation.

Professor Steve Keen believes even mild deflation is bad news. If the government continues with its programme of austerity, he is convinced the UK is heading for bad deflation. “Deflation is only benign, or even beneficial, in a world in which no one has any debt. Bizarrely, this is the world that conventional economists actually imagine we live in, since their models have ignored debt. Deflation increases the burden of people’s debt, which is what happened in the 1930s, during the Great Depression.”

The most immediate implication of continued deflation is that it makes a rise in interest rates less likely and, in the short term, this is good news for borrowers, but not for savers. This should also allow more time for the economy to recover, with low interest rates helping consumers and firms to access cheaper credit.

Source: News reports, 2016

How did you do?

Was this exam question helpful?

Explain the possible causes of a falling budget deficit

In 2017, the UK’s annual budget deficit was 2.3% of GDP, the lowest level since 2001. In 2017, the UK’s deficit on the current account of the balance of payments fell to 3.3% of GDP, the lowest level since 2011.

How did you do?

Was this exam question helpful?

Explain how fiscal policy can be used to try to improve the supply side of an economy.

In the 2016 Autumn statement, the UK Chancellor of the Exchequer, Philip Hammond, officially abandoned the government’s policy of trying to achieve a budget surplus by 2020. While some criticise the government for failing to achieve its fiscal target, others argue that the government should be doing more to help the supply side of the economy.

How did you do?

Was this exam question helpful?

Explain how government policies can reduce the natural rate of unemployment.

Between 2011 and 2016, UK unemployment fell from a high of 8.5% to 4.8%. Some argue that government attempts to reduce unemployment inevitably lead to trade-offs with other macroeconomic policy objectives.

How did you do?

Was this exam question helpful?

Explain how changes in both government spending and taxation might affect the level of economic activity.

The Government has ruled out the possibility of a rise in VAT before 2020 but other indirect taxes may increase. It has also stated that the personal income tax allowance will be increased from £10 800 in 2015/16 to £12 500 by 2020, and plans to cut the main rate of corporation tax from 20% to 17%.

How did you do?

Was this exam question helpful?

Extract B (lines 13–14) states: ‘It can be argued that supply-side reforms have gone too far in creating a highly flexible workforce and the government needs to do more in terms of protecting the nation’s workers’.

Using the data in the extracts and your knowledge of economics, evaluate the view that free market supply-side reforms to labour markets are beneficial to the UK economy

Extract B

Unemployment and real wages

According to a recent study on wage growth, the youngest worker today would need to wait nearly 80 years to see the average real wage in the UK double from its current level. At just 4.2%, unemployment in the UK is at its lowest level in decades. It should be the best of times, but data from the Office for National Statistics (ONS) show that the percentage of people who are ‘underemployed’, often working on zero-hours contracts, is greater than it was during the financial crisis of 2007–08. Some claim this is the true cause of poor real wage growth.

Supply-side reforms to labour markets are meant to boost productivity but can be damaging for some workers. Unregulated labour markets can lead to inequality and poor pay, which also reduces government tax revenue. Workers who are only temporarily employed can experience a lack of stability and firms may have little incentive to invest in human capital. Consequently, these workers may not get the opportunity to develop new skills. Firms may also face higher costs from replacing workers who leave because they feel undervalued.

It can be argued that supply-side reforms have gone too far in creating a highly flexible workforce and the government needs to do more in terms of protecting the nation’s workers. There are calls for some restoration of trade union powers, more rights for workers on zero-hours contracts and measures to raise pay to ensure that workers feel the benefits of employment.

Source: News reports, 2018

How did you do?

Was this exam question helpful?

Extract F (line 1) states ‘In most of the UK, reducing the budget deficit has focused on austerity rather than tax rises.’

Using the data in the extracts and your knowledge of economics, evaluate the view that there is a strong case for significant increases in UK income tax rates

Extract F

Scottish income tax

In most of the UK, reducing the budget deficit has focused on austerity rather than tax rises. However, the Scottish Government has announced that from April 2018, Scotland will have different rates of income tax to the rest of the UK, with changes that will see higher earners pay more and lower earners pay less. There will be a new tax band of 21% for those earning more than £24 000. The higher rate of tax will be increased from 40% to 41% and the top rate from 45% to 46%. A starter rate of 19% will also be introduced. The move to a ‘five-band’ income tax system should mean that nobody earning less than £33 000 in Scotland will pay more tax than they do now.

Estimates show that 55% of Scottish taxpayers will pay less compared to the rest of the UK under the new system, with higher earners paying more. Someone in Scotland earning £150 000 will pay £1774 more than if they lived elsewhere in the UK, with someone earning £40 000 paying £140 more. The extra revenue raised will be used to give public sector workers a 3% pay rise for those earning less than £30 000, and a 2% rise for those earning more than that, and will help towards the cost of providing superfast broadband to all premises in Scotland by 2021.

Some business leaders have warned that Scotland cannot afford to be associated with higher taxation than the rest of the UK. The Finance Minister for Scotland, Derek Mackay, claimed the changes could raise an additional £164 million and were necessary to “mitigate UK budget cuts, protect our NHS and other public services, support our economy and tackle inequality in our society”. He said the tax reforms would make “Scotland's income tax system even fairer and more progressive”. He resisted a bigger increase in the top rate of tax for those earning more than £150 000, aware that high earners may find ways to avoid paying it.

Source: News reports, 2017

How did you do?

Was this exam question helpful?

Evaluate whether achieving a budget surplus is a desirable objective of economic policy

In the 2016 Autumn statement, the UK Chancellor of the Exchequer, Philip Hammond, officially abandoned the government’s policy of trying to achieve a budget surplus by 2020. While some criticise the government for failing to achieve its fiscal target, others argue that the government should be doing more to help the supply side of the economy.

How did you do?

Was this exam question helpful?

Evaluate the economic consequences for the UK economy of a significant shift in the burden of taxation from direct taxes to indirect taxes

The Government has ruled out the possibility of a rise in VAT before 2020 but other indirect taxes may increase. It has also stated that the personal income tax allowance will be increased from £10 800 in 2015/16 to £12 500 by 2020, and plans to cut the main rate of corporation tax from 20% to 17%.

How did you do?

Was this exam question helpful?

Extract E (lines 17–18) states: ‘A low rate of corporation tax has also contributed to both short-run and long-run economic growth.

’With the help of a diagram, explain how a low rate of corporation tax may cause short-run and long-run economic growth.

Extract E: Made in Vietnam

Trade and foreign investment have helped Vietnam emerge from extreme poverty. Integration with global manufacturing has kept Vietnam’s economy growing even during the pandemic. In 2020, GDP rose by 2.9%, while many other countries experienced recession. The latest forecasts indicate an economic growth rate of over 8% in 2022.

Vietnam’s openness to trade and investment has made the country an important link in the global economy and it has been one of the five fastest growing countries in the world over the past 30 years. Its record has been characterised by steady growth compared to boom-busts in similar nations. According to the World Bank, Vietnam is a lower-middle income economy but the government wants it to become a high-income economy by 2045.

Vietnam’s development is often compared to that of China in the 1990s or early 2000s. Both are former command economies that now focus on export-led growth. However, Vietnam is very different in terms of the amount of foreign investment and its connection to global supply chains. Since 1990, Vietnam’s inflows of foreign direct investment have averaged 6% of GDP each year, more than twice the global average and a much higher percentage of GDP than China has ever recorded over a sustained period.

As many countries in Southeast Asia developed and wages rose, multinational corporations (MNCs) were attracted by Vietnam’s low labour costs and stable exchange rate. A low rate of corporation tax has also contributed to both short-run and long-run economic growth. Vietnam is also a member of the ASEAN free trade area and has bilateral trade deals with the European Union and the USA. In the past decade, exports have risen by over 140%. However, Vietnam has become increasingly dependent on foreign companies for growth and employment, while foreign competition has meant that many domestic firms have struggled.

Source: News reports, 2022

How did you do?

Was this exam question helpful?

Evaluate the view that increasing taxation is the best way to reduce a budget deficit

In November 2022, the UK government announced large public spending cuts and tax rises in order to reduce the budget deficit. Some economists worry that this may cause a negative multiplier effect and damage economic activity.

How did you do?

Was this exam question helpful?

Extract C (line 13) states: ‘High economic growth rates allowed Ireland to run a budget surplus in 2018 and 2019.’

With the help of a diagram, explain how high economic growth could help to create a budget surplus.

Extract C: Extra tax revenue?

According to figures published by the EU Tax Observatory, an independent research group, Ireland could collect an extra €12.4bn in corporation tax under the 15% global minimum corporation tax rate. The group stated that Ireland should not be that concerned about MNCs leaving the country. The biggest blow to Ireland’s low-tax regime came in 2015 when, under pressure from the EU, tax avoidance schemes known as the “double Irish” were made illegal. Under this scheme multinationals paid as little as 1% tax on their profits, a fraction of the 12.5% headline corporation tax rate.

The argument that the Irish Government would raise more tax revenue is simple: if all OECD members have a common minimum corporation tax rate, then global MNCs would not move to where taxation is lowest, and would just pay more tax in the countries in which they are located. The report finds developing and low-income countries will benefit less than more-economically-developed countries as most MNCs operate in high-income countries. High economic growth rates allowed Ireland to run a budget surplus in 2018 and 2019. However, Ireland is now running a large budget deficit, made worse by the pandemic, and any additional government revenue would be welcomed. Ireland also has an ageing population and could use the money to pay for pensions, social care and improved welfare.

Source: News reports, 2021

How did you do?

Was this exam question helpful?

Evaluate the view that supply-side improvements in the UK economy can best be achieved through the use of interventionist policies

In 2018, the European Commission estimated that Bulgaria and Romania were both experiencing positive output gaps whilst the UK was experiencing a negative output gap. Persistent output gaps can cause problems for economies which may be addressed by supply-side improvements.

How did you do?

Was this exam question helpful?

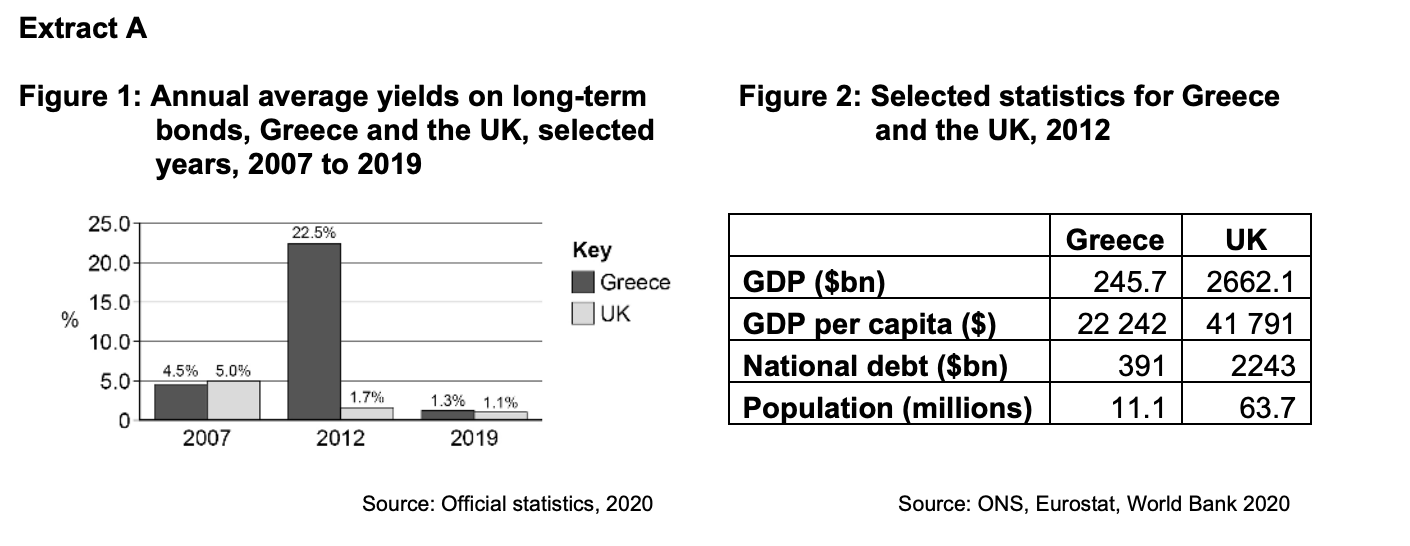

Explain how the data in Extract A (Figures 1 and 2) show that in 2012 Greece was more likely to have a problem with its national debt than the UK.

How did you do?

Was this exam question helpful?

Extract C (lines 17–18) states: ‘Some argue that the UK should increase taxes rather than add to the national debt.’

Using the data in the extracts and your knowledge of economics, evaluate the view that an increase in a country’s national debt is damaging for its economy

Extract C: The end of government cutbacks in the UK?

In 2019, the UK government’s debt repayment burden was at its lowest level in years and it was able to borrow at record low interest rates. Before the pandemic altered every governments’ fiscal plans, the UK government said they would rip up years of self-imposed budgetary constraints and increase spending to improve living standards. For years, austerity had led to under-funded public services and a low level of investment in the nation’s infrastructure.

The Chancellor of the Exchequer announced a planned increase in government expenditure of 4.1% in 2020, equivalent to £13.8bn, in a move designed to signal an end to austerity. This would have been the largest increase in 15 years.

The Chancellor said he was in a position to announce an increase in government spending after the annual budget deficit had fallen to 1.1% of GDP, well below the 2% target set by the Treasury. Under his plans, no government department would experience a real-terms reduction in its budget in 2020, and the Chancellor said this protection “is what I mean by the end of austerity”. Announcing the spending review in the House of Commons, he said the cost of government borrowing had fallen to historic lows, giving the government further room to increase its expenditure.

However, faced with an ageing population and significant poverty and inequality, the structural budget deficit is likely to increase over the next 30 years. Some argue that the UK should increase taxes rather than add to the national debt. Ongoing funding is needed to maintain and improve public services, such as healthcare, and to rebuild the UK’s social safety net by increasing spending on welfare to support the poor and vulnerable.

Source: News reports, 2020

How did you do?

Was this exam question helpful?