Oligopoly: Price & Non-Price Competition (AQA A Level Economics): Revision Note

Exam code: 7136

Competition in Oligopoly Markets

Firms in an oligopolistic market are highly competitive and can use price or non-price strategies to increase market share

There is a high degree of interdependence between competitors in an oligopoly market

Competitors closely watch each others actions

They are very responsive to new innovations

They use game theory to determine the best course of action

Non-price competition tends to be the most common way in which they compete

The focus of competition is on product differentiation to develop brand loyalty

E.g. Firms achieve this high levels of spending on advertising, branding, packaging, loyalty cards, etc

Price competition is less common, as firms want to avoid a price war

As goods and services are very close substitutes in an oligopolistic market, a price change initiated by one firm will cause other firms to react to price change

Individual firms will take into account the likely reactions of their competitors

This mutual interdependence leads to price stability or rigidity within the market

The kinked demand curve demonstrates the concept of price rigidity

The Kinked Demand Curve Model

The kinked demand curve provides one explanation of why prices are stable in oligopolistic competition

Rival firms react to price changes initiated by a competitor

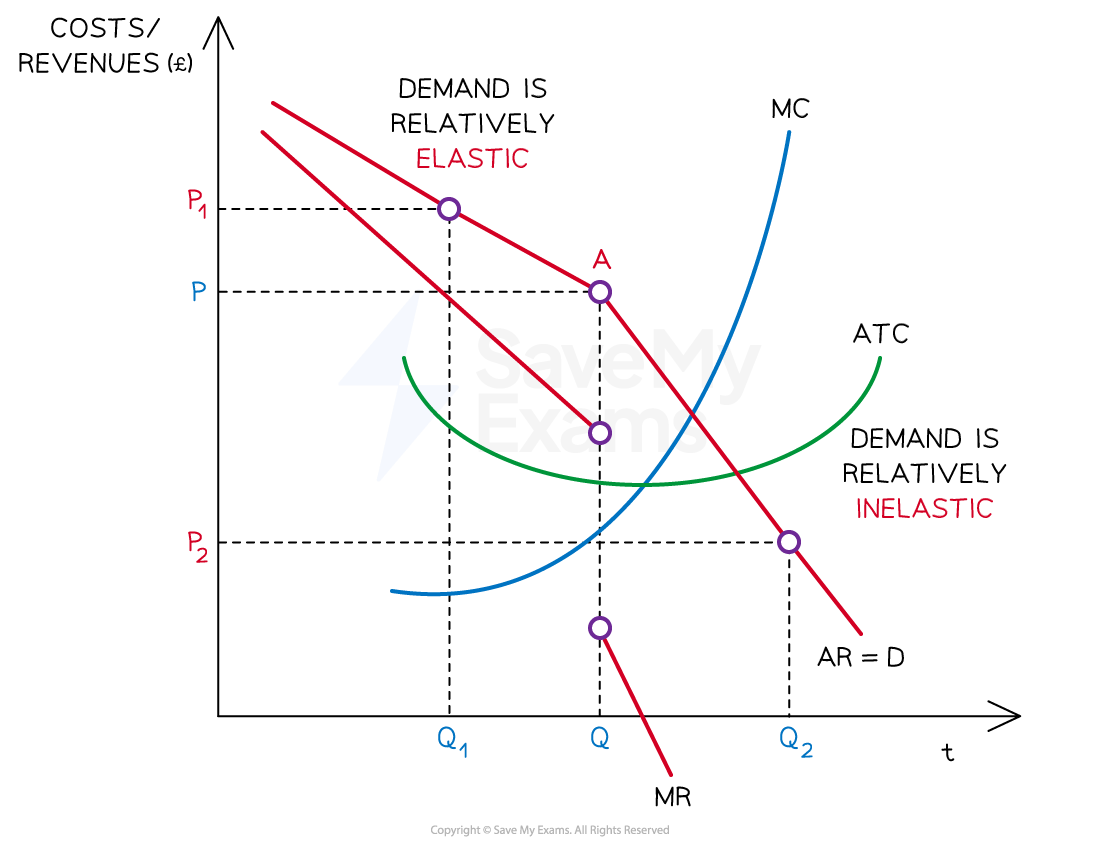

Diagram: Kinked Demand Curve

Diagram analysis

A firm produces a quantity of Q and sells at price P

Elastic section (above point A)

If a firm increases its price from P to P1, it is unlikely that rival firms will follow the price increase

The firm will lose consumers to rival firms if they charge a higher price

This means that a small increase in price leads to a greater than proportionate decrease in quantity demanded, resulting in an overall fall in market share and total revenue

This section of the demand curve is elastic

Inelastic section (below point A)

If a firm decreases its price from P to P2, it is likely that rival firms will respond by also decreasing price

All firms in the market will offer the new lower price

Market share remains the same. However, total revenue and profit decline for all

This means that a decrease in price leads to a less than proportionate increase in quantity demanded, resulting in an overall fall in total revenue

This section of the demand curve is inelastic

The change in elasticities, brings about a kink in the demand curve at a price level of P

This creates price rigidity, as firms tend not to change price due to the anticipated behaviour of competitors (mutual interdependence)

To avoid a price war, firms focus on non-price competition strategies to increase sales

This is why there is a high level of expenditure on research and advertising in oligopolistic industries

Reasons for Non-Price Competition

Firms in oligopolistic markets commonly engage in non-price competition

In other market structures, price competition is usually competitive

Several reasons push firms towards a focus of non-price competition

Reasons why Oligopolistic Firms Engage in Non-price Competition

|

|

|---|---|

Operation of cartels |

|

Price leadership |

|

Price agreements |

|

Price wars |

|

Barriers to entry |

|

The Advantages & Disadvantages of Oligopoly

Evaluating an Oligopoly Market Structure

Advantages | Disadvantages |

|---|---|

|

|

Unlock more, it's free!

Did this page help you?