Theories of Corporate Strategy (Edexcel A Level Business): Revision Note

Exam code: 9BS0

Development of corporate strategy

A successful corporate strategy helps to provide a competitive advantage

Effective corporate strategy development requires careful consideration of a range of internal factors and the external environment in which the business operates

Internal factors include the human and capital resources available

External factors include the economic and political environments

Two strategic models used to develop a corporate strategy are the Ansoff matrix and Porter's strategic matrix

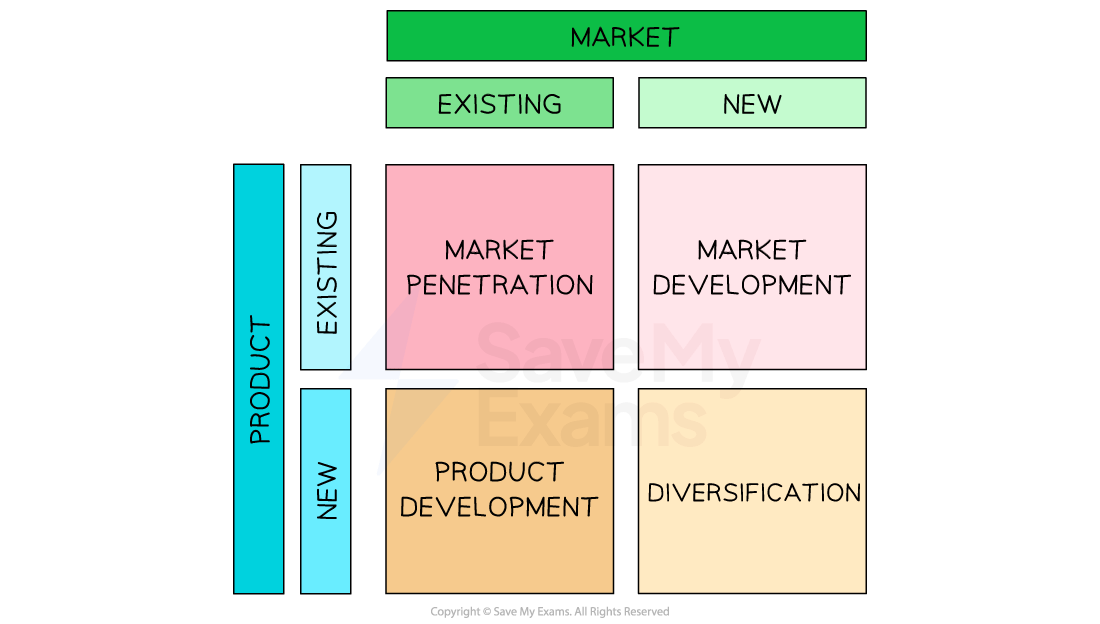

The Ansoff matrix

The Ansoff matrix is a tool for businesses with a growth objective

It is used to identify an appropriate corporate strategy and the level of risk associated with the chosen strategy

The model considers four elements, which are broken down into two categories:

The market — existing and new markets

The product — existing and new products

The Ansoff matrix: strategies for growth

The least risky strategy to achieve growth is to pursue a strategy of market penetration

This involves selling more products to existing customers by encouraging:

More regular use of the product

Increased use of the product

Brand loyalty of customers

Market development involves finding and exploiting new market opportunities for existing products by:

Entering new markets at home or abroad

Repositioning the product by selling to different customer profiles (selling to other businesses as well as directly to consumers)

Seeking complementary locations

For example, M&S Food has achieved significant growth since teaming up with fuel retailers such as BP and Applegreen and providing express retail outlets

Product development involves selling new or improved products to existing customers by:

Developing new versions or upgrades of existing successful products

Redesigning packaging and aesthetic features

Relaunching heritage products at commercially convenient intervals

For example, Cadbury relaunches Christmas-themed products each year, often with a subtle design change, to recapture the interest of customers

Diversification is the most risky growth strategy, as it involves targeting new customers with entirely new or redeveloped products

Examples of diversification include:

Tesco launching a range of financial products, including current accounts and credit cards

Greggs launching a range of themed clothing products

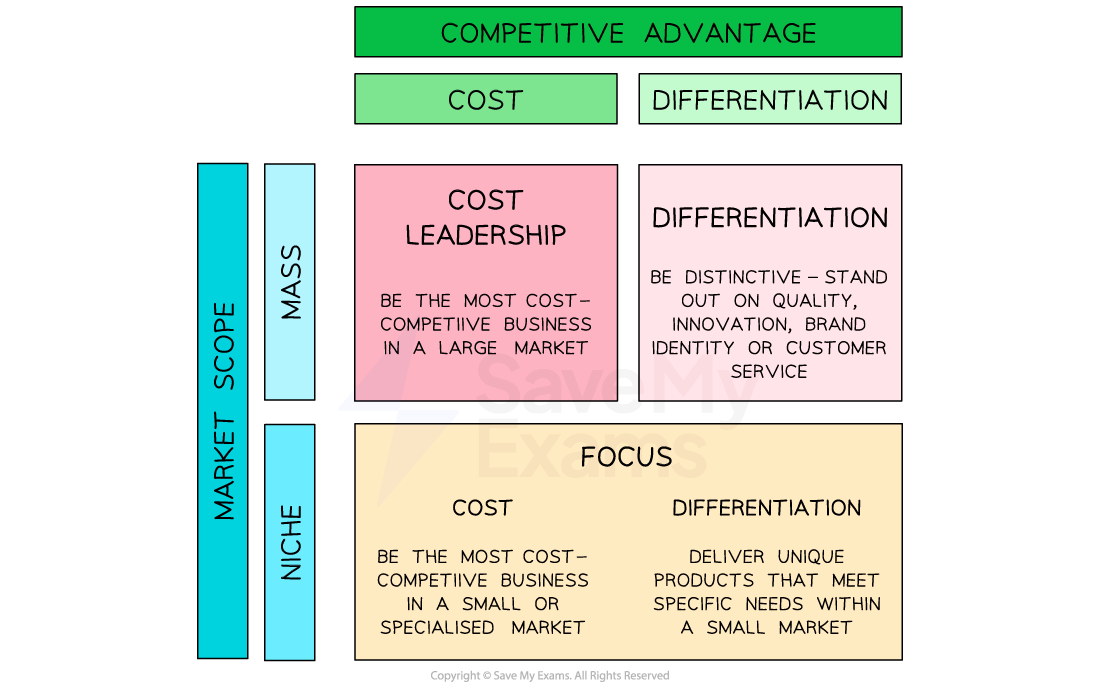

Porter’s generic strategic matrix

Porter’s generic strategic matrix identifies a range of strategies a business might adopt, considering:

Its source of competitive advantage (cost or differentiation)

The scope of the market in which it operates (mass or niche)

Porter argues that failing to adopt one of these strategies risks a business being "stuck in the middle" and unable to compete successfully with rivals in the market

Porter's generic matrix

Businesses operating in the mass market should adopt either a cost leadership or a differentiation strategy, depending on what it is that makes them stand out from their competitors

Businesses that have a significant cost advantage over competitors should exploit this as much as possible to achieve success, which is called cost leadership

Businesses that are unable to operate as the most competitive on cost should adopt a strategy of differentiation

A business that operates in a niche market should adopt a focus strategy that closely meets the needs of its specific group of customers

A cost focus involves being the lowest cost competitor within the market niche

A differentiation focus involves offering specialised products within the niche market

Portfolio analysis

Portfolio analysis involves a business carrying out a detailed evaluation of its full range of products so that appropriate strategies may be identified and pursued

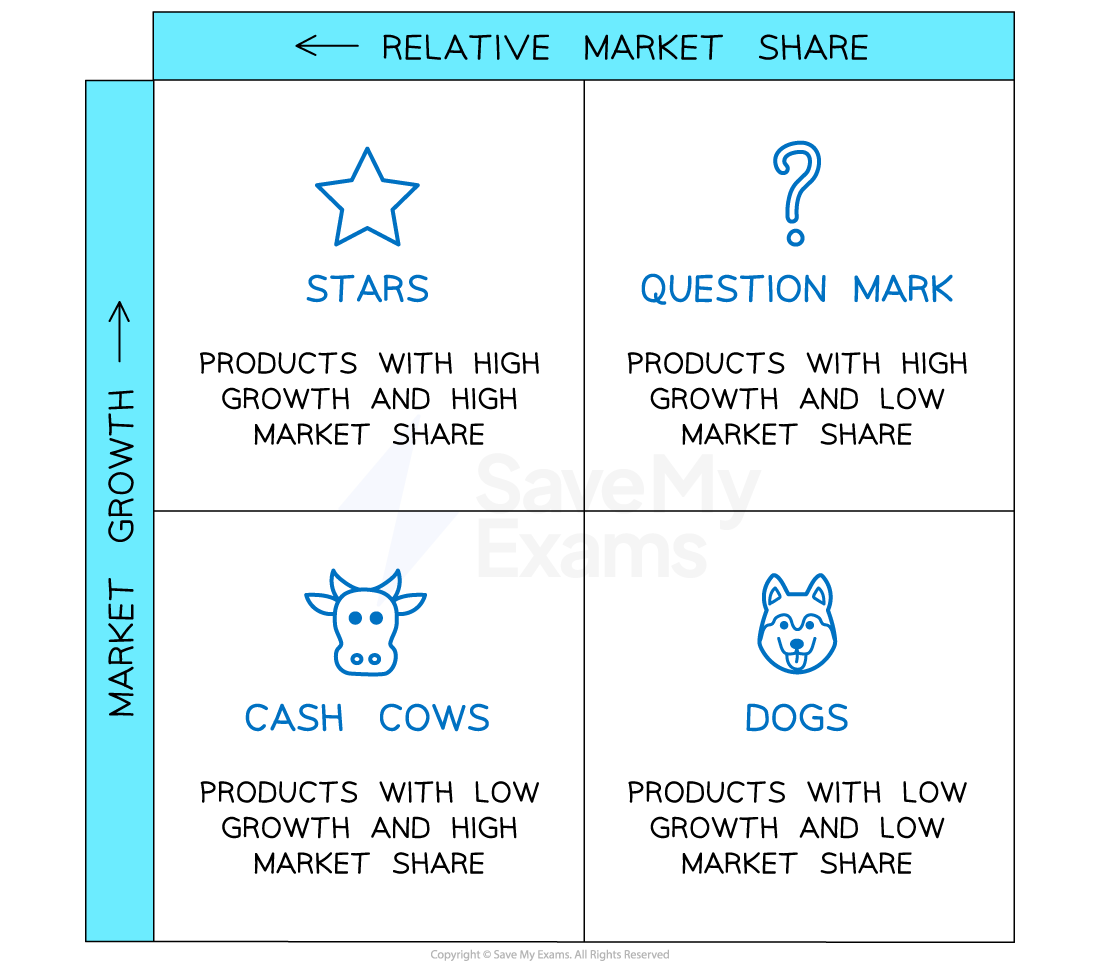

Boston matrix

The Boston Matrix is a portfolio analysis tool that considers the relative market share of a firm's products and the rate of growth within the market in which each product is sold

Stars are products sold in high-growth markets and have a high level of market share

Stars require some ongoing investment to maintain their market position and, if managed well, they are likely to become cash cows in the future

A market penetration strategy to increase sales revenue and maximise market share is likely to be appropriate

Cash cows are sold in lower-growth markets and have a high market share

Cash cows generate more cash than they need to maintain their market position and can be used to fund the development of other products in the portfolio

Businesses may seek new markets for these products if they are relatively risk-free

Question marks are sold in high-growth markets and have a relatively low market share

Question marks require significant investment if they are to improve their level of market share and become stars

There is a risk that question marks will become dogs when market growth rates slow

Dogs are sold in low-growth markets and have a relatively low market share

Dogs have little potential for future growth and should be divested so that finance and effort may be invested in other products

Achieving competitive advantage through distinctive capabilities

When a business has a particular strength that is very difficult for competitors to copy, it has a distinctive capability

The nature of that distinctive capability will determine the aims and objectives of the business and the strategies it will pursue to achieve them

Examples of distinctive capabilities

Distinctive capability | Explanation |

|---|---|

|

|

|

|

|

|

|

|

The effects of strategic decisions on resources

Strategic decision-making involves medium- to long-term planning to achieve corporate and functional objectives

It establishes the actions that the business intends to take to achieve its goals

Strategic decision-making will have an impact on a business's human, financial and production resources

Examples of the impact of strategic decisions on resources

Enter a new overseas market

Impact on human resources | Impact on financial resources | Impact on production resources |

|---|---|---|

|

|

|

Withdraw an obsolete product from sale

Impact on human resources | Impact on financial resources | Impact on production resources |

|---|---|---|

|

|

|

Merge with a competitor

Impact on human resources | Impact on financial resources | Impact on production resources |

|---|---|---|

|

|

|

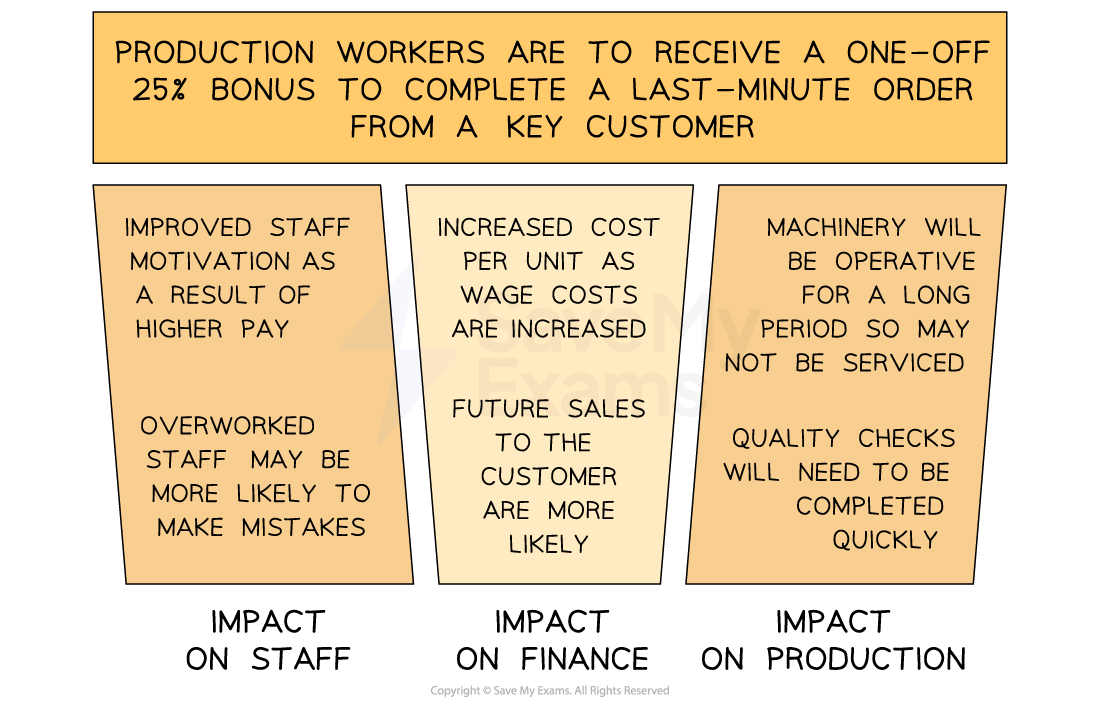

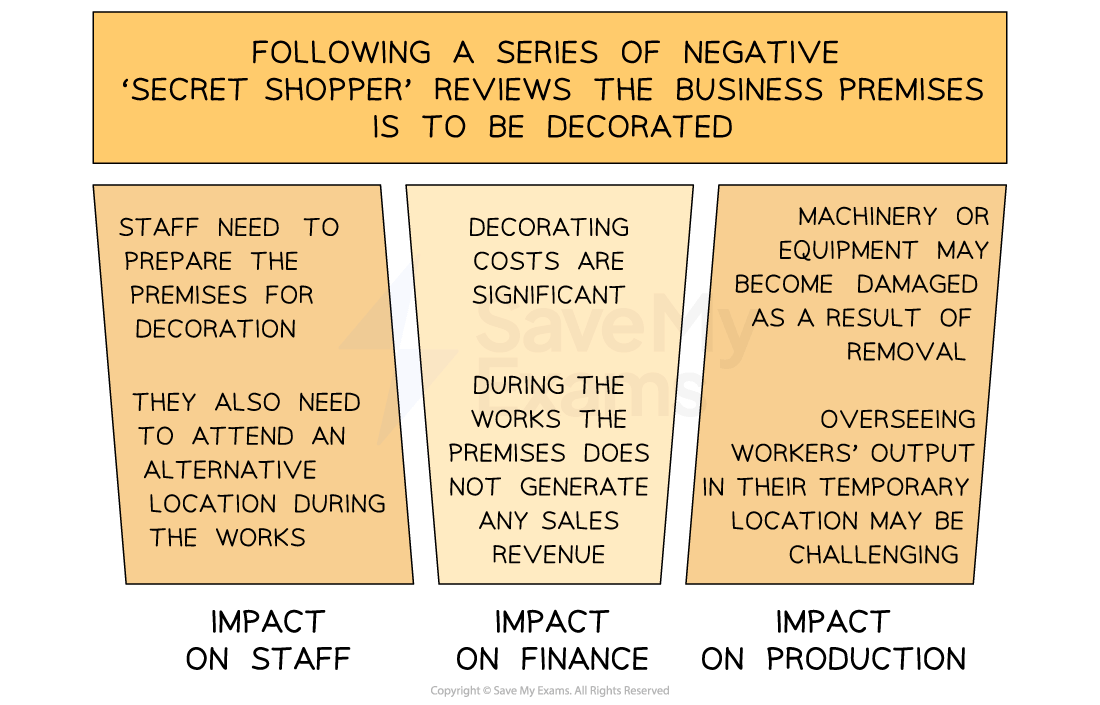

Examples of the impact of tactical decisions on resources

Tactical decisions are made to support the overall strategy and are usually short-term

Tactical decision-making will also have an impact on a business's human, financial and production resources

Awarding a bonus to workers

Decoration of business premises

Examiner Tips and Tricks

You should be able to distinguish between strategic and tactical decisions in a business context and make judgements about whether the distinction is useful in business.

Strategy is more long-term and relates to achieving an overall goal; tactics are shorter-term actions that help to achieve the strategy.

Unlock more, it's free!

Was this revision note helpful?