Economic Influences (Edexcel A Level Business): Revision Note

Exam code: 9BS0

The effects on businesses of changing economic variables

Economic influences can present significant opportunities and threats to business activities

Businesses need to anticipate and respond to changing economic variables in order to maximise their chance of success

The following economic variables need to be considered

Inflation

Inflation is the general rise in prices in an economy over time

The Consumer Price Index (CPI) measures monthly changes in the prices of a range of goods and services and compares these changes to earlier periods, calculating the rate of inflation

In the UK government, monetary policy focuses on achieving a 2% inflation rate and tasks the Bank of England with taking steps to maintain this (e.g. raising the interest rate)

After several decades of relatively low levels of inflation, the UK has recently experienced rapidly increasing levels

Rapid inflation is causing problems for businesses and households in the UK

High or fluctuating levels of inflation can be problematic for businesses for several reasons

Problems caused by inflation

Increased costs

Workers often demand higher wages to compensate for the increase in the cost of living

Suppliers increase the costs of raw materials and components

Utilities, such as electricity, become more expensive

Higher repayments on loans

Interest rates usually rise as the Bank of England uses the base rate as a tool to control inflation, making new and variable-rate borrowing more expensive

Consumers change spending habits

Inflation deters consumers from making significant purchases, and they may reduce demand for their usual lower-priced wants too, e.g cinema tickets

Purchasing on credit becomes more expensive

International competitiveness

Where domestic inflation rates are higher than those in other countries:

UK businesses are less likely to be competitive and lose sales

Imports from overseas competitors are likely to be cheaper than domestic goods

Uncertainty

This occurs when businesses cannot predict prices even in the short term

Survival may need to become the key business objective until stability returns

Spending and contract decisions are likely to be delayed

Exchange rates

The exchange rate is the value of one currency expressed in terms of another

Exchange rates are an important economic influence for businesses that import raw materials and components and for businesses that export their products

Exchange rates fluctuate for a range of reasons, including:

Changing demand for a currency

Economic growth

Changes to interest rates

The impact on business of changes in currency values

Change to currency value | Impact on exporting businesses | Impact on importing businesses |

|---|---|---|

An increase in the value of the £ against other currencies (appreciation) |

|

|

A decrease in the value of the £ against other currencies (depreciation) |

|

|

Examiner Tips and Tricks

Many businesses are affected as both importers of raw materials and components and as exporters of goods and services overseas.

It would be unusual for UK-based exporters to wholeheartedly celebrate a weak pound or be entirely dismayed at a strong pound, as the global nature of business means that for many firms, both costs and revenues are affected by exchange rate movements.

For most businesses, exchange rate stability is more important in the medium to long term because volatility makes planning, forecasting and setting objectives very difficult.

Interest rates

The interest rate is a percentage reward offered for saving money, and the percentage charged for borrowing money

Lenders commonly charge interest on borrowing at a rate higher than the Bank of England base rate

They then offer a lower rate on savings and investments

If interest rates rise, businesses will have to pay more on new or variable-rate borrowing, which will increase their costs

Businesses may be less willing to make capital investments when their retained profit may be more profitably invested in savings schemes

Customers are less likely to purchase goods on credit when interest rates are high, leading to a fall in sales

Exporting businesses may see the demand for their products overseas fall, as higher interest rates usually strengthen the value of the domestic currency and make their products comparably more expensive abroad

Taxation and government spending

Governments impose direct and indirect taxes on businesses and households

Direct taxes are levied on income, e.g. income tax and corporation tax

Indirect taxes are levied on spending, e.g. value-added tax (VAT)

The impact of an increase in taxation

Impact | Explanation |

|---|---|

Revenue |

|

Costs |

|

Business decisions |

|

Increased government spending is usually funded by increases in taxes or increases in public sector borrowing

Increased investment spending (e.g. on roads or regeneration) can encourage businesses to invest and lead to economic growth

Increased public sector spending can lead to targeted improvements (e.g in public health or education levels) that can improve productivity

In recent years, the UK government has focused increasingly on the reduction of government spending

Infrastructure projects have been scaled back or cancelled

E.g. the scale of the planned HS2 (High Speed 2) rail line intended to connect London with cities in the North has been significantly reduced

Businesses in cities such as Leeds and Manchester are now unlikely to benefit from more efficient transport links, which affects access to markets and workers

Spending on key services such as health and education has been reduced

Public sector wage rises have been limited

Businesses have been affected by ongoing strike action across the public sector, which has increased employee absence levels and made it difficult to function effectively

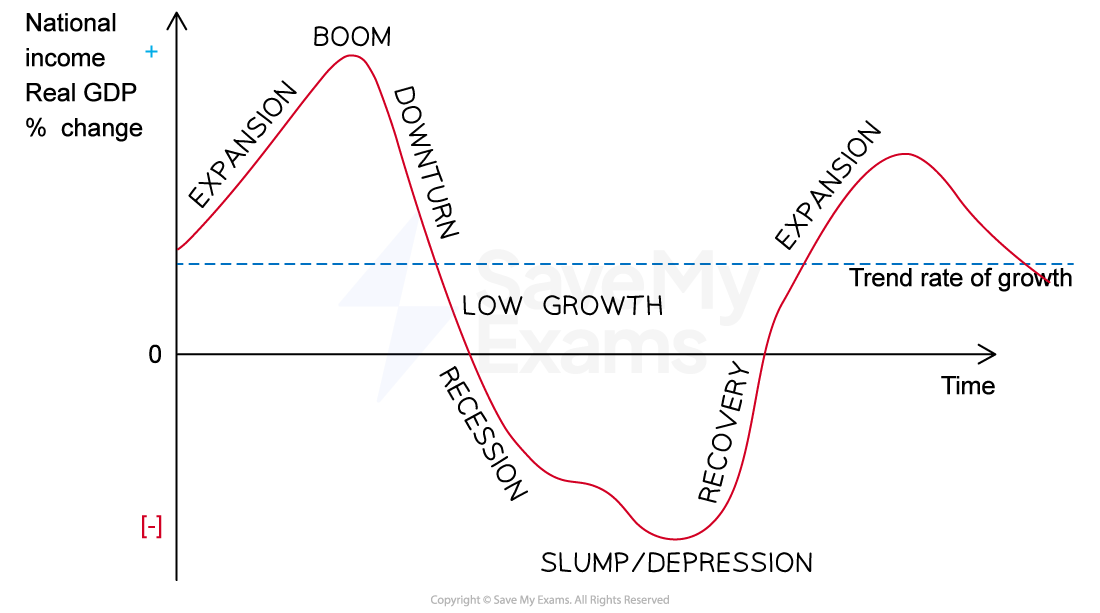

The business cycle

The business cycle describes the upturns and downturns in the level of a country’s economic activity (gross domestic product or GDP) over time

A recession occurs when an economy experiences two consecutive quarters (six months) or more of negative economic growth

A boom is defined as a period of time in which an economy experiences increasing/high rates of economic growth

The business cycle over time

Stage of the business cycle | Characteristics | Impact on businesses |

|---|---|---|

Recession |

|

|

Boom |

|

|

The effects of economic uncertainty on the business environment

Economic uncertainty occurs when it is difficult to forecast the level of supply and demand in an economy

Businesses will find planning difficult and are likely to be reluctant to make significant decisions, especially with regard to capital expenditure

Economic uncertainty may occur as a result of:

A fluctuating exchange rate

Economic growth uncertainty

Turbulence in the price of key commodities, such as oil

Businesses must always be prepared for economic uncertainty by:

Building up cash reserves when times are good

Keeping informed about the economic climate

Being ready to take advantage of opportunities when they arise

Examiner Tips and Tricks

MOPS is a useful acronym that could be used in 20-mark questions as a tool to place the business context at the heart of evaluative answers. It is frequently highlighted in the examiners' report as an example of good evaluative practice.

MOPS stands for:

Market

Objectives

Product

Situation

When you consider the impact of any external influence on a business’s decision, try to explain why some of these factors are relevant, with specific reference to evidence from the case study. This will help you make a balanced decision.

Unlock more, it's free!

Did this page help you?