Profit (Edexcel A Level Business): Revision Note

Exam code: 9BS0

Profit calculations

Profit is the money left over after all costs have been accounted for

There are several different types of profit

Types of profit

Type of profit | What does it show? | How is it calculated? |

|---|---|---|

Gross profit (GP) |

| GP = revenue − cost of sales |

Operating profit (OP) |

| OP = gross profit − operating expenses |

Net profit (NP) |

| NP = operating profit − (net interest + exceptional costs) |

Worked Example

An e-scooter manufacturer sells its products to retailers for £180 per unit. Variable costs are ⅖ of the selling price, with monthly fixed costs being £82,000. It sells 2,200 scooters a month.

The business pays £240 interest on a mortgage each month. This year, it purchased the patent for a new type of rechargeable battery for £17,000.

Calculate the business's net profit for the year.

[5]

Step 1: Calculate the variable cost per unit

Step 2: Calculate the gross profit per unit (selling price − variable cost per unit)

[1]

Step 3: Calculate the gross profit per month (gross profit per unit × units sold)

Step 4: Calculate the gross profit per year (gross profit per month × 12)

[1]

Step 5: Multiply monthly fixed costs by 12 (months)

Step 6: Subtract the annual fixed costs from the annual gross profit

[1]

Step 7: Multiply the monthly interest by 12 (months)

[1]

Step 8: Add the one-off purchase to the annual interest

Step 9: Subtract the interest and one-off costs from the operating profit

[1]

Examiner Tips and Tricks

You may not be asked to complete all of these calculations in one question.

The question may, for example, provide the gross profit and some other information and then ask you to calculate the net profit.

Look at the data carefully to ensure you are doing the correct calculation.

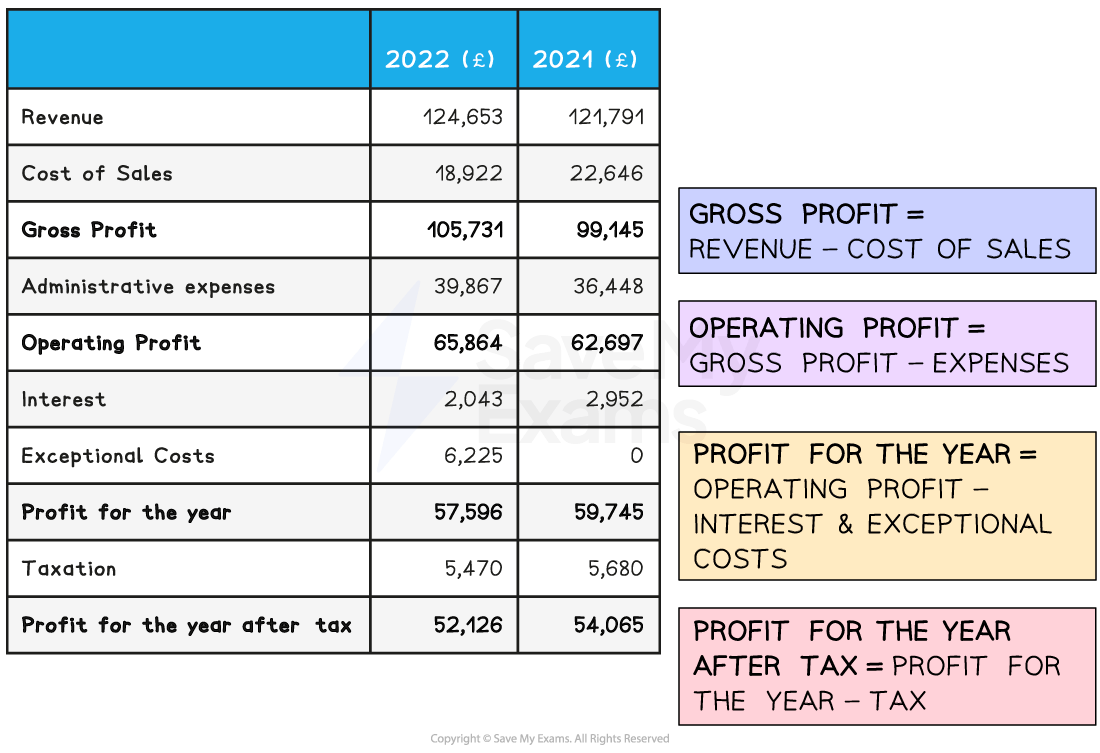

Statement of comprehensive income (profit and loss account)

The statement of comprehensive income is an end-of-year financial statement that shows all of a business's income and expenses over the previous 12 months

Each type of profit is calculated within the statement of comprehensive income

The previous year’s figures are also shown for comparison purposes

Example statement of comprehensive income for Head to Toe Wellbeing Ltd

Profit margins

A profit margin is the amount by which the sales revenue exceeds the costs

Profit margins can be calculated for each type of profit (gross, operating and net profit)

Profit margins can be compared to previous years to better understand business performance

Higher and increasing profit margins are preferable, as it means that more revenue is being converted to profit

Gross profit margin

This shows the proportion of revenue that is turned into gross profit and is expressed as a percentage

It is calculated using the formula

Worked Example

Head to Toe Wellbeing Ltd's revenue in 2022 was £124,653. Its gross profit was £105,731.

Calculate Head to Toe Wellbeing’s gross profit margin in 2022.

[2]

Step 1: Substitute the values into the formula

[1]

Step 2: Multiply the outcome by 100 to find the percentage

[1]

Operating profit margin

The operating profit margin shows the proportion of revenue that is turned into operating profit and is expressed as a percentage

It is calculated using the formula

Worked Example

Head to Toe Wellbeing Ltd’s revenue in 2022 was £124,653. Its operating profit was £65,864.

Calculate Head to Toe Wellbeing’s operating profit margin in 2022.

[2]

Step 1: Substitute the values into the formula

[1]

Step 2: Multiply the outcome by 100 to find the percentage

[1]

Net profit margin

The net profit margin (also known as the profit for the year margin) shows the proportion of revenue that is turned into net profit before tax and is expressed as a percentage

It is calculated using the formula

Worked Example

Head to Toe Wellbeing Ltd’s revenue in 2022 was £124,653. Its profit for the year was £57,596.

Calculate Head to Toe Wellbeing’s profit for the year margin (net profit) in 2022.

[2]

Step 1: Substitute the values into the formula

[1]

Step 2: Multiply the outcome by 100 to find the percentage

[1]

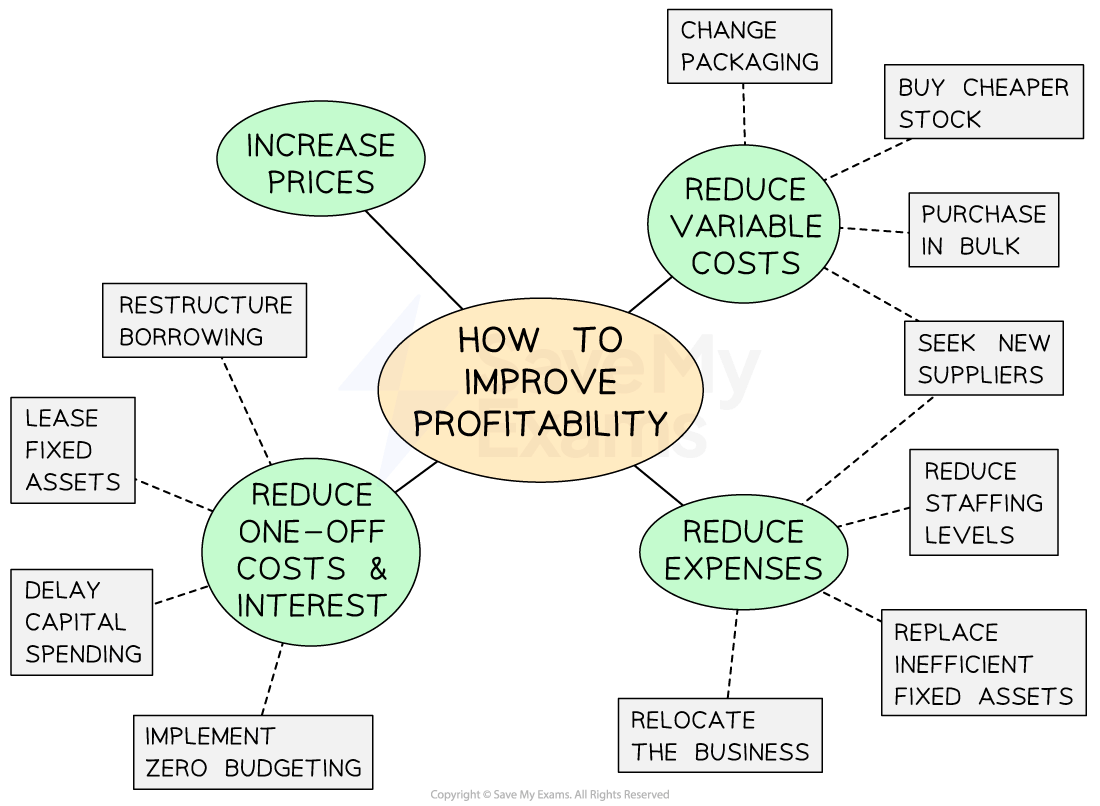

Ways to improve profitability

There are several steps a business can take to improve profitability

Main ways to improve profitability

Raising prices

If costs remain the same, raising prices will improve profitability, as the difference between the selling price and the cost is now greater

Raising prices is likely to have an impact on demand, so a business must understand the price elasticity of demand for its products

Where demand for products is price elastic, increasing prices will result in lower revenue — in this case, profitability will be reduced

Where demand for products is price inelastic, increasing prices will increase revenue — in this case, profitability will rise

Reducing variable costs

This may involve purchasing cheaper/alternative resources, negotiating with suppliers or purchasing in bulk

Businesses must ensure that reducing variable costs will not have an adverse effect on the quality or desirability of products

Buying stock in greater quantities may require investment in increased storage space, which will reduce the impact of the cost savings made

Businesses may also be able to reduce the waste of raw materials and components

Reducing other expenses

Reducing staffing levels, relocating to cheaper premises or changing utility companies can reduce expenses

Reducing staffing levels may affect staff morale and negatively affect productivity

Relocation costs can outweigh some of the benefits of moving to a cheaper location

Replacing inefficient or outdated equipment may require staff training

Reducing one-off costs and interest charges

Delaying the purchase of fixed assets, entering leasing arrangements or restructuring borrowing can reduce costs

Delaying purchases of new fixed assets (e.g. machinery or vehicles) may negatively impact capacity utilisation as a result of increased breakdowns and maintenance of the old equipment

The leasing of equipment (e.g. photocopiers) can reduce one-off purchase costs, but the business never owns these assets, which weakens the balance sheet

Restructuring borrowing can result in lower monthly payments but requires lenders to agree to new terms, which they may not be willing to do

The distinction between profit and cash

Profit and cash are different financial terminologies

Profit is simply the difference between revenue generated and business costs

Cash is measured by taking into account the full range of money flowing in and out of a business

A new business may have to pay cash on purchase for all its supplies until a good business relationship has built up a level of trust with its suppliers

A supplier may then give the business trade credit of 30 or 60 days

This means that the business can receive its stock now and only pay for it in 30 or 60 days, so the cash outflow is delayed

As the business sells its products, it receives money generated from the business revenue, and this represents a cash inflow

At the end of 60 days, the business will pay its supplier (cash outflow), but the firm may still have stock available for sale

A profitable business is likely to fail if it does not have sufficient cash

Cash-poor businesses will struggle to pay their suppliers

E.g. lifestyle retailer Joules announced plans to liquidate in December 2022 as a result of cash flow difficulties despite making a profit of £2.6 million during the previous year

Unlock more, it's free!

Did this page help you?