Budgets (Edexcel A Level Business): Revision Note

Exam code: 9BS0

The purpose of budgets

A budget is a financial plan that a business (or department in the business) sets for costs and revenue

The budget is usually closely aligned with the business objective

Reasons for using budgets

Reason | Explanation |

|---|---|

Planning and monitoring |

|

Control |

|

Coordination and communication |

|

Motivation and efficiency |

|

Types of budgets

Budgets are usually set annually and then monitored on a monthly basis

Businesses may set budgets to monitor the financial performance of any aspect of the business

Budgets are generally prepared using one of two methods:

Historical figure budgets

Zero-based budgeting

Historical figure budgets

Budgets are usually based on historical data (e.g. sales and costs data from previous years) and allow for factors such as inflation and other relevant economic indicators (e.g. exchange rate variations)

Zero-based budgeting

In some cases, businesses make the decision not to allocate budgets and use a zero-budgeting approach

This is particularly useful when a business needs to control costs closely (e.g. to improve profitability)

Zero budgeting requires all spending to be justified, which means that many unnecessary costs can be eliminated

It can be time-consuming, as evidence to support spending decisions needs to be collected and presented

Zero budgeting also requires skilled and confident employees to make a persuasive case to convince those who are making purchasing decisions

Variance analysis

A budget variance is the difference between the figure budgeted and the actual figure achieved by the end of the budgetary period (e.g. 12 months)

Variance analysis seeks to determine the reasons for the differences between the actual figures and the budgeted figures

Favourable variances

A favourable variance is when the actual figure achieved is better than the budgeted figure

A favourable variance in a revenue or profit budget is when the actual figure is higher than the budgeted figure

A favourable variance in a costs budget is when the actual figure is lower than the budgeted figure

Adverse variances

An adverse variance is when the actual figure achieved is worse than the budgeted figure

An adverse variance in a revenue or profit budget is when the actual figure is lower than the budgeted figure

An adverse variance in a costs budget is when the actual figure is higher than the budgeted figure

Worked Example

Selected financial information for Bunsen PLC in 2022

| £m |

Budgeted sales revenue | 12,460 |

Actual sales revenue | 13,718 |

Budgeted total costs | 8,420 |

Actual total costs | 10,627 |

Using the data, calculate the total profit variance for Bunsen PLC in 2022. You are advised to show your workings. [4]

Step 1: Calculate the budgeted profit for 2022

[1]

Step 2: Calculate the actual profit for 2022

[1]

Step 3: Subtract the budgeted profit from the actual profit for 2022

[1]

Step 4: Identify the nature of the variance

In this case, the variance is adverse because the actual profit for 2022 is lower than the budgeted profit for 2022

The correct answer is £949 in adverse variance [1]

Examiner Tips and Tricks

Although the Bunsen PLC example shows an adverse profit variance, it is worth noting that the company’s actual sales revenue was higher than budgeted. There could be some sales executives in the business who deserve some sincere congratulations!

You may recommend that the business investigate the reasons for the adverse profit variance. The focus of the examination must be on the higher-than-budgeted costs rather than on this seemingly positive sales performance. You may recommend that Bunsen review its supply agreements or that it adopt a zero-budgeting approach.

Once variances have been identified, a business should carefully investigate the reasons why the variances have occurred and take appropriate action, such as:

Where adverse cost variances are identified, a business may seek alternative suppliers or investigate ways to improve efficiency

Where adverse sales variances are identified, a business may review its marketing activities to improve their effectiveness

Where favourable cost variances are identified, a business may review key quality indicators such as the volume of returns or waste levels to ensure that output standards are being met

Where favourable sales variances occur, a business may reward client-facing staff with performance-based incentives

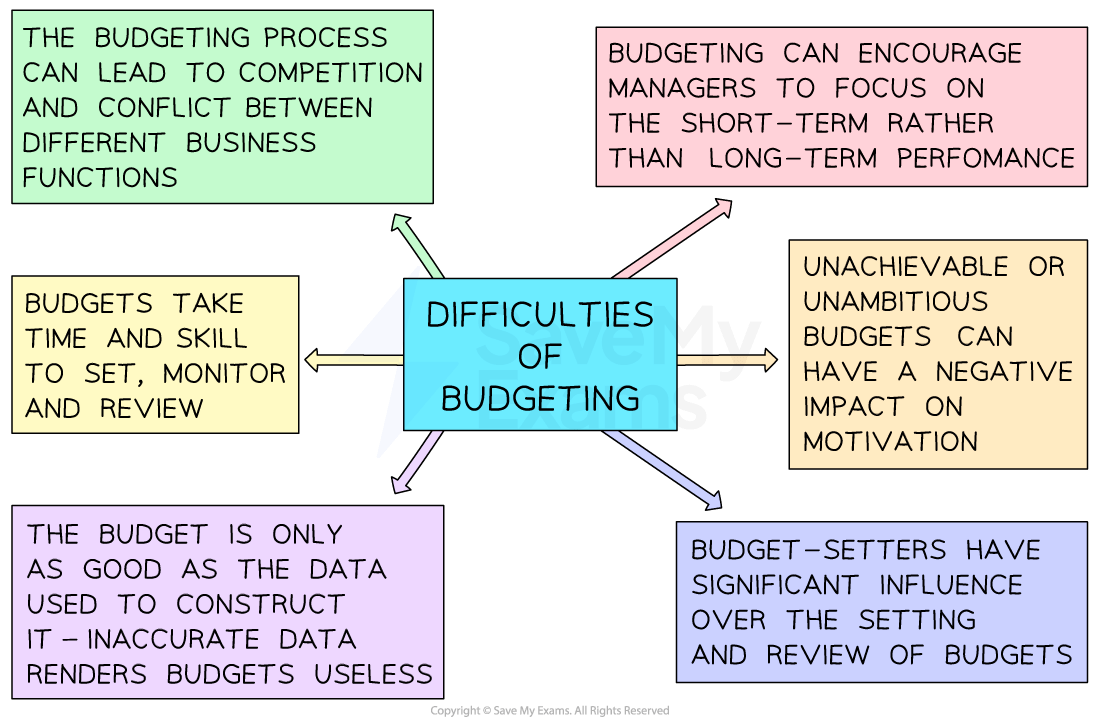

Difficulties of budgeting

Budgeting requires significant expertise to be of genuine use to a business, and there are several difficulties associated with its construction

The main difficulties of budgeting

Data must be up-to-date, accurate and free of bias

Sources of data must be selected carefully and used with care to ensure the most appropriate assumptions are made

Those who are constructing budgets will require skills and relevant experience to do so effectively

This may involve training or the recruitment of specialist staff

Budgets can encourage managers to focus on the short-term rather than the long-term success of the business, as budgets are usually set year to year

Unrealistic budgets (over or under) can lead to a lack of motivation among those tasked to achieve the financial plan

Conflict between budget holders may arise, reducing the effectiveness of the business as a whole

Unlock more, it's free!

Was this revision note helpful?