Sales, Revenue & Costs (Edexcel A Level Business): Revision Note

Exam code: 9BS0

Calculation of sales volume and sales revenue

Sales volume is the number of units sold by a business

For example, the number of Harry Styles album download purchases

Sales revenue is the value of the units sold by a business

For example, the revenue earned by Apple Music from sales of music downloads

Sales revenue is a key business performance measure and must be calculated to identify profit

Sales revenue is calculated using the formula:

Sales revenue usually increases as the sales volume increases

When a firm sells one product, it is easy to calculate the sales revenue

The more products a firm sells, the harder it is to calculate the sales revenue

Computer systems make it easier to track sales revenue when multiple products are sold by the business

Worked Example

Fotherhill Organics Limited sold 39,264 packs of its specialist compost to mail-order customers in 2022. The price per pack was £8.75. In addition, it sold 4,280 tonnes to gardening businesses for £123.95 per tonne.

Calculate Fotherhill Organics' sales revenue for 2022.

Step 1: Calculate the sales revenue from sales to mail-order customers

Step 2: Calculate the sales revenue from sales to gardening businesses

Step 3: Add together the two sales revenue figures

An introduction to costs

In preparing goods/services for sale, businesses incur a range of costs

These costs can be broken down into different categories

Fixed costs

Fixed costs (FC) do not change as the level of output changes

These have to be paid whether the output is zero or 5,000

For example, building rent, management salaries, insurance and bank loan repayments

Variable costs

Variable costs (VC) vary directly with the output

These increase as output increases and vice versa

For example, raw material costs and wages of workers directly involved in production

Total costs

Total costs (TC) are the sum of FC and total VC

Calculation of fixed, variable and total costs

Based on the above definitions, we can calculate several different types of costs

Formulas to calculate different types of costs

Type of cost | Formula |

|---|---|

TC | = Total FC + total VC |

Total VC | = VC per unit × quantity |

Average TC (unit cost) | = TC ÷ quantity produced |

VC per unit | = Total VC ÷ quantity produced |

Example: cost calculations where variable costs = $60

Output (Q) | FC | TVC = | TC = | AVC = | AC = |

|---|---|---|---|---|---|

0 | 200 | - | 200 | - | - |

1 | 200 | 60 | 260 | 60 | 260 |

2 | 200 | 120 | 320 | 60 | 160 |

3 | 200 | 180 | 380 | 60 | 126.67 |

4 | 200 | 240 | 440 | 60 | 110 |

5 | 200 | 300 | 500 | 60 | 100 |

6 | 200 | 360 | 560 | 60 | 93.33 |

7 | 200 | 420 | 620 | 60 | 88.57 |

8 | 200 | 480 | 680 | 60 | 85 |

Variable costs per unit

VC per unit are calculated by adding together the cost of each component or raw material used to produce the unit

Worked Example

Rosebud Aromas manufactures luxury scented candles. The production of each candle incurs the following VC:

VC | Cost per candle (£) |

|---|---|

Wax | 0.14 |

Perfume oil | 0.72 |

Telephone bill | 24.32 |

Glass jar | 1.46 |

Outer packaging | 0.33 |

Calculate the VC in pounds sterling for each candle.

Step 1: Identify the VC in the list

A telephone bill is classified as an FC, so it should not be included in the calculation. [1]

Step 2: Total the VC listed

Examiner Tips and Tricks

Take care when calculating VC per unit, as it is likely that one or more FC will be included in the list, as seen above.

Diagrammatic representation of costs

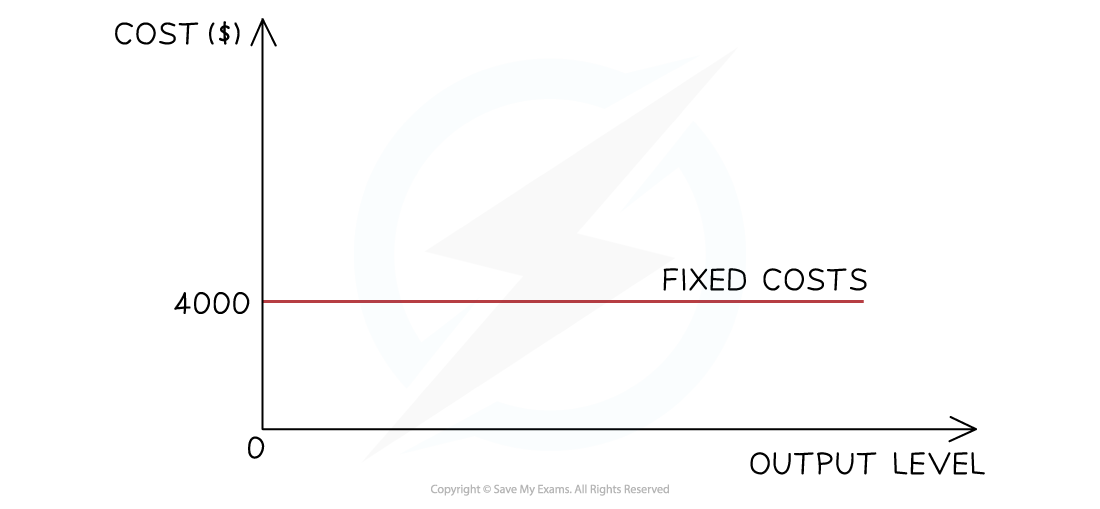

Fixed costs

The firm has to pay its fixed costs, which do not change according to output

The FC for this firm are $4,000

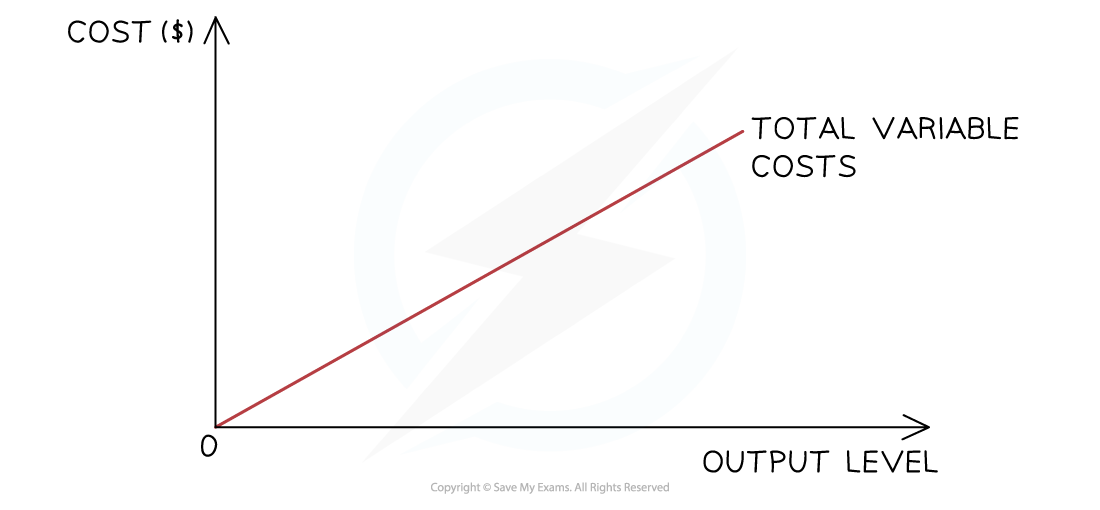

Variable costs

The VC initially rises proportionally with output, as shown in the diagram

At some point, the firm will benefit from purchasing economies of scale, and the rise will no longer be proportional

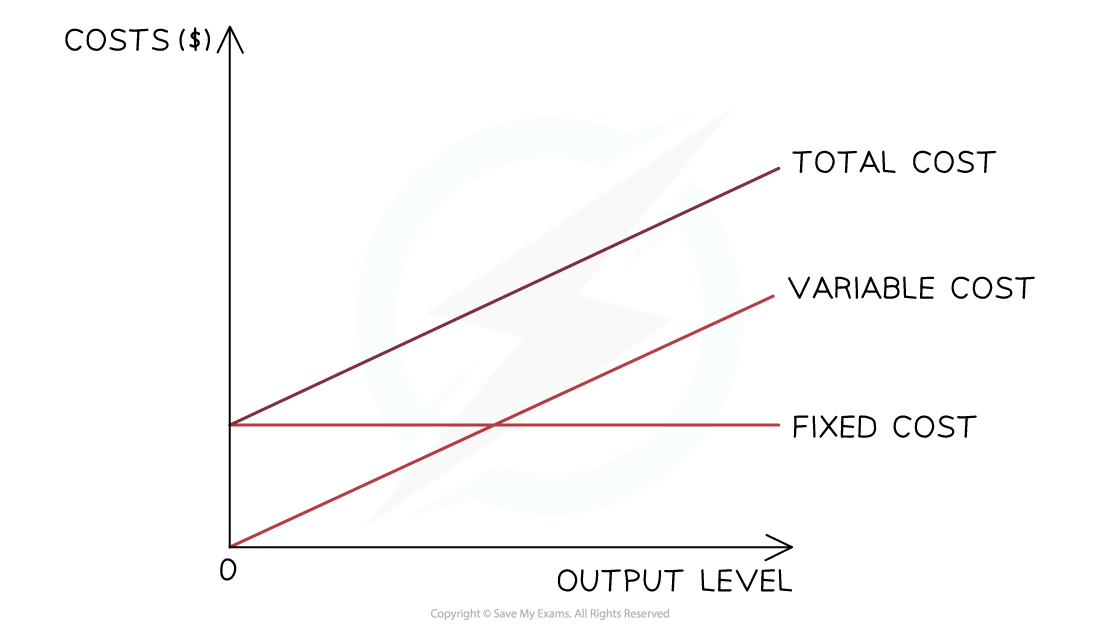

Total costs

The TC are the sum of the VC and FC

The TC cannot be zero, as all firms have some level of FC

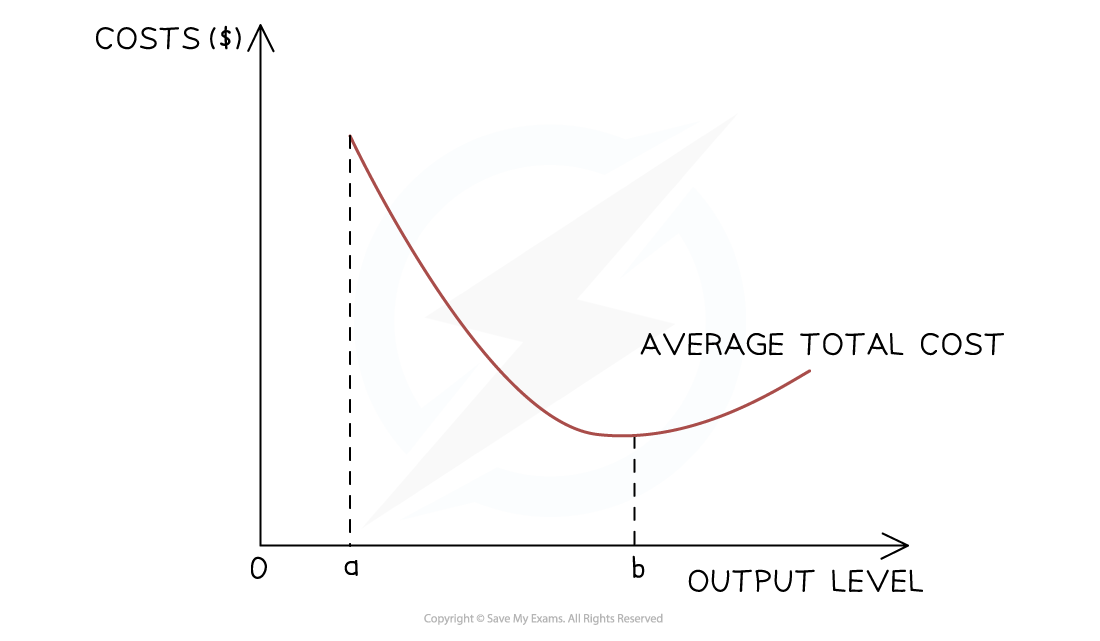

Average total costs

As a firm grows, it can increase its scale of output, generating efficiencies that lower its average total costs (AC) of production

These efficiencies are called economies of scale

As a firm continues increasing its scale of output, it will reach a point where its AC will start to increase

The reasons for the increase in the average costs are called diseconomies of scale

Contribution

Contribution refers to a product’s selling price minus the VC directly involved in producing that unit

Contribution can be calculated using the following formula:

It is called "contribution", as this amount contributes towards paying off the FC of the business

Once the FC have been paid off, the contribution starts to contribute to the profits of the business

Contribution is used to calculate the break-even point

Worked Example

Rosebud Aromas manufactures luxury scented candles. The production of each candle incurs the following VC:

VC | Cost per candle (£) |

|---|---|

Wax | 0.14 |

Perfume oil | 0.72 |

Glass jar | 1.46 |

Outer packaging | 0.33 |

Each candle is sold for an average wholesale price of £15 to retail outlets. Calculate the contribution for each candle.

Step 1: Calculate the total VC per candle

Step 2: Deduct the total VC per candle from the selling price

Unlock more, it's free!

Was this revision note helpful?